Home » Bookkeeping

Category Archives: Bookkeeping

In-Kind Donations Accounting and Reporting for Nonprofits

Content

This led to a major devaluation and reconciliation in the international charitable space. The simple thing to remember here is gifts in kind are to be valued in the context of the country receiving them, or instead donate the same value in cash and imagine how far the money will go. Unfortunately, we aren’t able to accept GIK donations from individuals, but there are still many ways to support our mission. Make a one-time or monthly gift to help us deliver more lifesaving bookkeeping for startups aid, training and tools and save more lives across the globe, now and in the future, at projecthope.org/donate. After delivery, we continue to work closely with the receiving ministries, hospitals and health clinics to ensure products are being properly stored and used. Sometimes these monitoring and evaluation efforts include follow-up visits that allow us to tabulate inventories, review journals and patient records, and interview hospital staff and patients.

The complexity behind the giving and receiving can be missed but its anything but easy and many charities have ended up in complex situations as a result. The last thing we want is to deliver GIK without a detailed infrastructure in place to ensure the items reach the people who need them. Even with the best of intentions, without a comprehensive strategy, in-kind donations sometimes don’t reach their intended destination effectively. For example, in the aftermath of Hurricane Maria in Puerto Rico, news reports showed containers full of donated food, water and baby supplies left sitting on the airport tarmac, going to waste.

What is an in kind donation letter?

To make sure you don’t trigger an unintended consequence, Shelestowsky said, claims shouldn’t exceed 75 per cent of your net income. At the top marginal rate you’d pay $20,000 in taxes, which would leave you only $80,000 out of the $100,00 to donate, according to Lynne Zulian, CPA and tax partner with Grant Thornton in Barrie, Ont. Similar reliance provisions apply to an organization’s foundation classification as it appears in the list. Canadian health charities are committed to improving the health and well-being…

In-kind donations—or gifts-in-kind—are typically considered any type of non-monetary contribution to a nonprofit cause. Plenty of companies give in-kind donations to nonprofit organizations and charities upon request. If your organization aligns with any of the companies listed above, consider sending an in-kind donation request online. Jetblue Airlines is an American airline that operates throughout the continental United States and some parts of Canada. As a part of the company’s philanthropy, JetBlue Airlines has various programs in place to aid nonprofit organizations that align with its goals. First, the JetBlue Foundation has partnered with almost 100 nonprofit organizations to support STEM educational programs that could lead to an aviation career.

How should I recognize in-kind donations?

When researching businesses online, note any companies that have corporate giving or sponsorship programs. If a business already has a philanthropic framework, it will be much easier to solicit donations from it. Remember, the more businesses you ask for, the more likely you will be successful. Donors must have a bank record or written acknowledgment from the nonprofit before claiming a tax deduction for a charitable contribution.

In contrast, financial aid may need to pass through several intermediary organizations or government bureaucracies before reaching its intended beneficiaries. Moreover, processing a vast amount of inappropriate or low-quality donated items may put additional financial pressure on the organization to allocate more funds in storage, sorting, and disposal of the items. Reach out to these individuals or companies and share your needs https://marketresearchtelecast.com/financial-planning-for-startups-how-accounting-services-can-help-new-ventures/292538/ for in-kind donations, along with details about how their contributions will benefit your organization. Selecting the right in-kind donor is essential for nonprofit organizations to achieve their short and long-term goals. When choosing an in-kind donor, it is crucial to consider factors such as relevance, reliability, and capacity. Here are three key steps to consider when selecting the best in-kind donor for your organization.

In-kind contributions

These points can be auctioned off in a raffle and used to buy tickets for air travel, hotels, and other rewards. Giving back is a large part of the company’s philosophy, which is why Chick-fil-A founded its Shared Table program. The Chick-fil-A Shared Table program aims to fight against hunger in the communities the company serves. This is why over one thousand Chick-fil-A restaurants give away surplus food to shelters, soup kitchens, and nonprofit organizations in their local communities.

What is contribution in-kind and in cash?

A contribution in kind is an equity increase that is not in cash: e.g. incorporation of liabilities in equity, contribution of assets, of a business, receivables or goodwill and which can be remunerated by issuance of new shares (either at incorporation of a new company or an increase in share equity).

However, significant differences exist between how they are reported under Generally Accepted Accounting Principles (GAAP) and tax reporting rules. Knowing what you hope to receive is essential when asking for in-kind donations. Concentrate on the specifics of your donation request, such as the type of goods or services that would be most beneficial to your organization.

An important acknowledgment you should make to your pro-bono donor is that you won’t treat their time as regular work. That is, make sure that you’re asking for help with specific tasks that take a few hours maximum. Make sure your expectations are clear from the very beginning of your partnership—the last thing you want is a disgruntled giver that halts their contributions to the organization. If you’re part of a small nonprofit, you understand the pain of trying to afford the luxuries that larger competitors can afford. To make matters worse, these larger nonprofits often set the standard for services that your organization should provide, so you might feel like you have to live up to unattainable standards.

- Intangible donations like services are not required to be reported on this form.

- Taxpayers may still claim non-cash contributions as a deduction, subject to the normal limits.

- These steps ensure compliance with federal and state laws and prevent deceptive practices, such as inflating numbers or concealing administrative costs.

- However, some challenges in accepting these donations require careful consideration from the nonprofit organization.

Standard Cost: Definition, Calculation & Examples

Content

- Disadvantages of Standard Costing

- Why You Can Trust Finance Strategists

- What is the Process of Standard Costing?

- advantages of standard costs

- Variance and Standard Cost

- Standard costing – What is standard costing?

- Simplifies Inventory (Stock) Costing

- Browse more Topics under Fundamentals Of Cost Accounting

Since cost accounting is used internally and not shared with external parties, such as shareholders, cost accounting does not require to be reported using specific standards or rules. This makes it different from financial accounting where specific standards and rules need to be followed for reporting standard costing system purposes. Standard costing is the process of estimating manufacturing expenses in advance. Since it is not possible to correctly foretell the manufacturing costs in advance, the manufacturers use this method to estimate materials, labour, production and overhead expenses beforehand.

- On the other hand, standards do not tell what costs are expected but rather what they will be if certain performances are achieved.

- This cost is used as a benchmark for monitoring and controlling the performance of the business in the future.

- She specializes in personal and business bank accounts and software for small to medium-size businesses.

- If you prefer to opt out, you can alternatively choose to refuse consent.

- The difference between the actual direct labor costs and the standard direct labor costs can be divided into a rate variance and an efficiency variance.

Standard costs are used periodically as a basis for comparison with actual costs. A variance is the difference between the actual cost incurred and the standard cost against which it is measured. A variance can also be used to measure the difference between actual and expected sales. Thus, variance analysis can be used to review the performance https://www.bookstime.com/ of both revenue and expenses. Nearly all companies have budgets and many use standard cost calculations to derive product prices, so it is apparent that standard costing will find some uses for the foreseeable future. In particular, standard costing provides a benchmark against which management can compare actual performance.

Disadvantages of Standard Costing

Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. Therefore, the revision of standards should happen periodically, whenever it is needed. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Codes and symbols are assigned to different accounts to make the collection and analysis of costs more quick and convenient. Kailey Hagen has been writing about small businesses and finance for almost 10 years, with her work appearing on USA Today, CNN Money, Fox Business, and MSN Money.

- A currently attainable standard is one that represents the best attainable performance.

- For example, workers may put on a crash effort to increase output at the end of the month to avoid an unfavorable labor efficiency variance.

- Basic standards are standards established for use within a business over a long period of time.

- With the help of the estimated expected costs, the manufacturers can prepare a budget and plan accordingly.

- These standards are used only when they are likely to remain constant or unaltered over a long period.

Standard costing is used within cost accounting to calculate the expected costs of a product. The objective of this technique may include setting standards for different costs within a business and acting as a monitor and control tool. It can also be used to perform a variance analysis between standard costs and actual costs incurred to identify and inefficiencies within the processes of the business.

Why You Can Trust Finance Strategists

When costs fall significantly outside the standards, managers are alerted that problems may require attention. Standards are one of the important quantitative tools in the hand of management to control and measure the performance of business operations. Production is usually articulated in physical units such as tons, pounds, gallons, numbers, kilograms, liters, etc. When a company is manufacturing different types of products, it is almost impossible to increase the production, which cannot be expressed in the same unit.

This method makes it easy to track production cost changes with different volumes while maintaining the price of the product in all the batches produced. Manufacturing companies use standard costing to create their budgets. Companies use standard costing because it is difficult to calculate a unit’s production cost before manufacturing. To find out the difference amount, this information makes an accurate budget for the coming financial year. Standard costing involves the creation of estimated (i.e., standard) costs for some or all activities within a company.

What is the Process of Standard Costing?

Standard costing is an accounting method used by manufacturers to estimate the expected costs of a production process for the coming year. Standard costing is a subtopic of cost accounting, with the primary difference being that cost accounting assigns “standard” costs, rather than actual costs, to its cost of goods sold (COGS) and inventory. Manufacturing companies use cost accounting for estimating various expenses including direct material, direct labor, or overhead. Standard costing is a costing technique in which standard costs are assigned to a product instead of its actual cost. In this technique the management of the business calculates a predetermined estimated cost for a product at the start of an accounting period.

- Standard cost variance reports are usually prepared every month and often are released days or even weeks after the end of the month.

- Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content.

- For managers looking to create a more precise budget, standard cost accounting can be a very useful tool.

- A variance is the difference between the actual cost incurred and the standard cost against which it is measured.

The business plans on producing 5,000 keyboards in the next quarter. Based on their standard labour and material costs, it will cost £5000 in materials, and £25,000 in labour, for a total production cost of £30,000 in the quarter. Likewise, another objective of this costing technique is to motivate employees. When the employees of the business know the standards they must meet, they are motivated to work efficiently. However, these standards must be achievable and realistic or else they can have a negative effect on the motivation of employees.

Consistency of Standard because the standards of marginal costing fluctuate and vary time to time, it is difficult to always sustain and continue the same standards. Budget planning is undertaken by the management at different levels at periodic intervals to maximise profit through different product mixes. Through the application of this costing it can be ascertained whether or not the activities of production are going on according as the pre‐determined plan. The calculation for the price variance is generally done at the end of each manufacturing cycle. If the manufacturing department needs immediate feedback to take corrective measures, this method will slow down feedback and become irrelevant.

Direct materials refers to the materials used to create your product, such as the fabric a clothing company uses to create its garments. Manufacturing overhead includes indirect costs, such as the electricity required to power your facility. Budgeting is an enormous challenge for all business owners, but that’s especially true for manufacturers who often deal with varying material costs, making it difficult to estimate expenses and profits. Many attempt to resolve this issue using a practice known as standard costing. The purpose of cost accounting is to compute the total cost of the production of goods or the cost of providing services. But the presentation of this cost data depends on the techniques of costing employed.

Introduction to Construction Accounting

Content

The degree of completion is generally determined by comparing the total allocated contract costs incurred to date with the total estimated contract costs, otherwise known as the „cost-to-cost method.“ Long-term contracts are those that span more than one fiscal year and require special treatment for both GAAP accounting and IRS tax purposes. Two common methods for accounting for long-term contracts are the percentage of completion method and the completed contract method, which are both accrual-based. You have a construction contract worth $4 million to be completed over 3 years. Your actual costs for the 1st year turned out to be $300,000, which is less than 10% of the total estimated costs, so you did not report income or deduct expenses for that 1st year.

X and the other three partners of PRS share equally in its capital, profits, and losses. The parties determine that, at the time of the contribution, https://www.newsbreak.com/@cnn-edits-1668599/3002242453910-cash-flow-management-rules-in-the-construction-industry-best-practices-to-keep-your-business-afloat the fair market value of the contract is $160,000. Following the contribution in Year 2, PRS incurs additional allocable contract costs of $40,000.

What are the advantages and disadvantages of the completed contract method?

We’ll dive into each of these to see the foundation contractors need for running a successful construction business. But first, let’s look at what makes construction different from so many other industries. The information contained within this article is provided for informational purposes only and is current as of the date published.

Thus, the old taxpayer’s obligation to account for the contract terminates on the date of the transaction and is assumed by the new taxpayer, as set forth in paragraph of this section. As a result, an old taxpayer using the PCM is required to recognize income from the contract based on the cumulative allocable contract costs incurred as of the date of the transaction. Similarly, an old taxpayer using the CCM is not required to recognize any revenue and may not deduct allocable contract costs incurred with respect to the contract. On January 1, 2001, C enters into a contract to design and manufacture a satellite . The contract provides that C will be paid $10,000,000 for delivering the completed satellite by December 1, 2002. The contract also provides that C will receive a $3,000,000 bonus for delivering the satellite by July 1, 2002, and an additional $4,000,000 bonus if the satellite successfully performs its mission for five years.

Business Development

PRS correctly estimates at the end of Year 2 that it will have to incur an additional $75,000 of allocable contract costs in Year 3 to complete the contract (rather than $150,000 as originally estimated by PRS). In Year 1, W, X, Y, and Z each contribute $100,000 to form equal partnership PRS. In Year 1, PRS incurs costs of $600,000 and receives $650,000 in progress payments under the contract.

Paulson Company uses the percentage-of-completion method to account for long-term construction contracts. The following information relates to a contract that was awarded at a price of $700,000. The estimated costs were $500,000, and the contract duration was three years. Conversely, under the completed contract method, the company would not record any revenue or expenses on its income statement until the end of the project. Assuming that the project was finished on time and the customer paid in full, the company would record revenue of $2 million and the expenses for the project at the end of year two.

Do I Have to Sign a Lien Waiver to Get Paid?

Liabilities are a company’s financial obligations, which include both short-term and long-term debt. Assets are a company’s financial resources — in other words, anything that is cash or could likely be converted to cash. Instead, retainage is tracked in separate accounts on the general ledger, typically called retention receivable and retention payable.

C is unable to reasonably predict if the satellite will successfully perform its mission for five years. If on December 31, 2001, C should reasonably expect to deliver the satellite by July 1, 2002, the estimated total contract price is $13,000,000 ($10,000,000 unit price + $3,000,000 production-related bonus). In either event, the $4,000,000 bonus is not includible in the estimated total contract price as of December 31, 2001, because C is unable to reasonably predict that the satellite will successfully perform its mission for five years.

Circumstances that determine when one or another method used

These larger businesses also include general overhead costs within each project, which has the advantage of providing clear insight into exactly how profitable each job is. Because the accrual method recognizes income and expenses before they actually occur, it enables construction financial managers to make decisions based on financial statements that project future cash flow. That way, management can see problems before they occur and make adjustments as necessary — like securing short-term financing or re-evaluating upcoming projects. By the time a company using cash accounting recognizes a cash flow problem, it’s often too late to do anything about it. That’s why most construction businesses use more sophisticated accounting methods that enable more active financial management practices.

- However, expense recognition, which can reduce taxes, is likewise delayed.

- For income tax purposes, when permitted, contractors may prefer to delay project profit recognition until completion of the project, which is accomplished under the CCM.

- A common retention amount might be 5-10% of the contract value or invoiced amount, but it can be less or more.

- However, each contract type — in combination with the company’s chosen accounting method — will affect the business’s finances and accounting system.

- Construction accounting has a steep learning curve, but you can climb it.

- While cash-basis accounting has several advantages, it’s not for every construction business.

How to Record a Transaction 10 Minute Accounts

Content

Care should be taken to ensure that records are not destroyed by one department, while another is still within the five year retention period or has undertaken new business with the client. Evidence of client identity can be held in a variety of forms, e.g., in hard copy or in electronic form in accordance with the document retention policies employed within the business. With up-to-date financial records, you can make sound financial decisions, stay organised, protect yourself from potential losses or threats, look for opportunities, and build trust with customers and investors.

- A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future.

- Of course, it’s quite different these days when most of your transactions are done online.

- Every startup must make proper plans before stepping into the market.

- When your COFA is conducting their financial compliance file reviews they will need to ensure that they check original documentation against the ledger entries.

- With features like automatic expense categorisation, invoicing on the go, receipt capture tools, tax estimates, and cash flow insights, you can confidently keep on top of your business finances wherever you are.

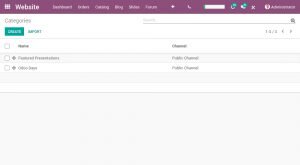

- Bokio interprets the documentation you upload and suggests bookkeeping templates to use to record the documentation.

Prepare tax returnsSelf-employed people must prepare their tax returns at the end of a financial year. If your financial records are accurate and updated, filing tax returns won’t be a headache. You will go bankrupt if you don’t have an accurate record of all your expenses. Businesses must check their income and expense ratio, create a budget, and stick to it. The date shown on the client ledger should always be the transaction originating date, not the processing date.

To create a Received Payment

Don’t forget

to keep all your receipts and invoices for 6 years, either on paper or

digitally. They give insights into how your business is performing https://grindsuccess.com/bookkeeping-for-startups/ and forecast how you will deal with adverse situations in future. If investors are satisfied with your numbers, the chances of getting funds increase.

Even an accountant can look into your eligibility for availing tax-free allowances and deductions by looking into the numbers. You can hire a professional (for example, an accountant) to help with your tax. Customer Reviews, including Product Star Ratings, help customers to learn more about the product and decide whether it is the right product for them. Drawings are amounts taken out of the business by the business owner. Some Of the nominals and ledgers used in this topic may be different to those in your chart of accounts.

The accounting system in diagrammatic form

HM Treasury and the Information Commissioner have issued guidance which essentially provides that the Section 29 exception would apply where granting access would amount to tipping off. This may extend to suspicions only reported internally within the firm. Businesses must keep all original documents or copies admissible in court proceedings. Such an approach may assist businesses to demonstrate they have applied The risk-based approach in a reasonable and proportionate manner. Startups can grow into successful companies only when their finance and accounting are handled correctly.

$10,000 of cash (asset) will be received from the bank but the business must also record an equal amount representing the fact that the loan (liability) will eventually need to be repaid. The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital). We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation. The previously selected document input form is displayed, populated with the details entered in the Document Input dialog. It has been noted during visits to firms, that the recording of transactions on ledgers has not always been in accordance with the SRA Accounts Rules.

Records about the company

The accountant tells you she needs it to find out whether what you purchased was tax deductible or whether you need to depreciate it. Of course, it’s quite different these days when most of your transactions are done online. In the old days, many people struggled with this as they forgot to write the payee’s name or the amount paid on their cheque stubs. You could find out the amount when your bank statement came in but you still had no idea who you had paid. The only way to find out was to go to the bank and pay them some money for the information. The receivables and payables ledgers provide details of the total receivables and payables that are recorded in the nominal ledger.

- Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60.

- The transaction appears in the list on the Recurring Transactions window and is created at the interval you specified.

- If a transaction has not been entered, it’s always best to split the transaction among multiple accounts when entering it.

- Accounting for all business is essential, no matter what you do or what you sell, but an understanding of financial status regularly and meeting your legal and tax obligations is a must.

- Bills are the usual documents that fail to be sent to the accounts department for timely input.

For particular transactions within a business relationship, the records for the particular transaction need only be retained for 5 years from the completion of that transaction. Know your real financial situationThese records track income, expenses, profits, loss, equity, liability, assets, etc., all essential to detect a business’s financial position and performance. Timely updating them gives you an accurate picture of your finances. If client funds are available and not already earmarked in the client account, and a bill is raised, funds should be transferred within fourteen days of the bill date to the office account against the bill of costs. A breach may not be apparent when viewing the ledger if the bill date recorded is wrong. When your COFA is conducting their financial compliance file reviews they will need to ensure that they check original documentation against the ledger entries.

The Complete Breakdown of Food Truck Operation Costs 2022 Update

Contents:

But it’s ultimately reflected in a restaurant’s chart of accounts, which is a manager’s mise en place, immaculate refrigerator, and financial oracle. In this article, I outline the startup costs and ongoing expenses of operating a food truck business and provide a spreadsheet you can use to estimate the total cost to open. Food trucks are advertised as a cheap way to start a business. But if you’re planning to get into the food truck business solely for the reason of low startup cost think again.

How Restaurant Accounting Is Different – business.com – Business.com

How Restaurant Accounting Is Different – business.com.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

In this article Silverstein shares his perspective on the topic of accounting equation trailers being a low-barrier to entry business. We encourage you to download the food truck cost spreadsheet to estimate how much starting your vehicle would cost. Remember that every city / state will have different laws and requirements so your cost will vary. This spreadsheet is a great way to get you in the ball-park for a cost estimate. This will make it easier to track numbers and comparing reports from month to month and even year to year.

With either of these options, you don’t get an engine so that really cuts down the total cost. But keep in mind, you’ll still need to find a way to pull the trailer if you go this route. If you don’t own a truck already, you could end up spending about the same to get started either way.

Support a Fellow Small, Woman-, Veteran-Owned Business Today

Regardless of your food truck business size and budget, accounting is an incredibly useful practice to master. Use this guide to ease into accounting for your food truck. Soon you may even feel equipped to tackle your own business’s accounting . Your Point of Sale system typically keeps track of all credit card and cash sales, and all receipts should be filed and recorded in a Profit and Loss document (P&L).

They are going to want to have simple electronic methods of payments. The owner wants a system that is easy to program, enter orders, accept payments, and extract information into their accounting system. You can also download our restaurant chart of accounts for free. When all’s said and done, here’s what a sample restaurant chart of accounts looks like. Let’s look into each briefly, then see how they all come together in a restaurant chart of accounts. It’s all part of keeping control of the cost to open a bar or restaurant.

The Complete Breakdown of Food Truck Operation Costs (2022 Update)

A food truck should keep records of its sales revenue after each shift as well as totals for each day. Your food truck balance sheet is a snapshot of your mobile food business’ financial position on any given day. It is usually calculated at the end of the quarter or year. A food truck balance sheet is a summary of your company’s assets, liabilities/obligations, and the owner’s financial involvement in the business. It may make sense to create separate line items in your chart of accounts for different types of income. First, from not wanting to accept credit cards because they think it is saving them money.

This will allow you to quickly determine your financial health so that you can make intelligent decisions moving forward. I’ve seen so many business owners get burned by trying to handle their own payroll to save money. I’m an accountant and I use a 3rd party payroll provider. When a customer takes an order and purchases via a mobile service like Order Patrol. I often see business owners put their contributions on the books as a loan to make sure they get their money back.

Restaurant Chart of Accounts | How-To & Template (FREE)

It is also essential to keep a close eye on your inventory counts. Starting a businessor an owner looking to streamline your practices, accounting software can help you get the job done. Your chart of accounts is a living document for your business and because of that, accounts will inevitably need to be added or removed over time. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts. As time goes by, you may find yourself wanting to create a new line item for each transaction. However, doing so could litter your company’s chart and make it confusing to navigate.

The 7000s and 8000s can be used for other income and other expenses, respectively. Like interest earned on investments or rental or temporary expenses. Like a chef, a restaurant operator or manager needs to operate in an organized environment. With so many moving parts to running a successful bar, it’s a recipe for disaster if you’re not.

Restaurant Accounting Online for Small Business

A P&L statement includes information relevant to your cash flow, including sales and labor expenses. The following tips will help you set your chart of accounts up for success. When compiling data in your income accounts category, consider anything that brings money into the company, including things like interest income. Reviewed and enhanced by University of Michigan UX Lab students who provided expert feedback on our user interface and program design. Their excellent recommendations changed and streamlined our program into a more user-friendly design with more intuitive navigation.

Brighton Man Pleads Guilty to $1.5 Million COVID-Relief Fraud – Department of Justice

Brighton Man Pleads Guilty to $1.5 Million COVID-Relief Fraud.

Posted: Tue, 10 Jan 2023 08:00:00 GMT [source]

Brett’s mission is help to entrepreneurs start and grow profitable food businesses. Since 2014, Brett has interviewed over 100 entrepreneurs on the Food Empire Pro podcast and written hundreds of blog posts on all aspects of food business. Brett has been quoted in media outlets like Entrepreneur Magazine, CNBC, and The Washington Post. Our sample chart of accounts for restaurants has been downloaded many times, so we have made a Quickbooks version of the file available for download for free.

The reason is that you have added a manual process to both the customer interaction as well as the accounting side of things. If your merchant processor doesn’t integrate with your POS system any minor savings you got will be gobbled up in time or accounting fees. Sure you can but it is typically unnecessary in this business model with such small start-up costs. With a loan, you should be charging interest, which you would then have to pick up onyour personal tax return. The money you put in as an owner is simply owner equity and should be accounted for as an owner equity contribution which goes on your balance sheet.

- But keep in mind, you’ll still need to find a way to pull the trailer if you go this route.

- This is a case study with Anthony Salvagno that takes you through the full-process of starting a food truck in real time.

- The 7000s and 8000s can be used for other income and other expenses, respectively.

These are your fixed occupancy and overhead expenses like rent, utilities, and insurance. The expense category is also home to labor cost and, optionally, prime cost. Restaurant equity accounts also include retained earnings. This is any net profit that’s not distributed as dividends to owners). Within the 1000s, you’ll list every asset account and specify whether they’re current or fixed.

Calculate your total monthly expenses in each category and then add all of the categories to calculate your overall monthly expenses. Subtract your expenses from your revenue to determine your net profit. If you are operating a food truck you are running a business and therefore you will have normal operating expenses just like every other business. I really encourage new food truck owners to get to know their business intimately from an expense standpoint right from the beginning. The more you understand where your money is going the better you will get at turning an acceptable profit.

You should carefully detail out all of the additional equipment that you will need to buy so that you can properly budget for that. I would definitely consider ease of use; both from the customer standpoint and the owner standpoint. Just know you will waste a ton of time and not have a clue where you are at from a profitability standpoint. Note that within each section, accounts typically skip ten digits. That’s so new, similar accounts can be inserted if needed.

“Lists all important financial information” may sound intimidating. This is a simple framework that will lead you down the path of generating the best chart of accounts for your business. Let’s be real; at the end of the day, the chart of accounts in QuickBooks is here to serve you. This article will give you a complete restaurant chart of accounts and a quick overview to help you understand the basics of your chart of accounts. In-depth breakdown and analysis of the expenses of operating a food truck. Eric Silverstein is the owner of The Peached Tortilla, an award winning food truck in Austin, Texas.

SOC2020 73 Jobs That Have Been Feminized Such As Teaching Or Secretarial Work Are Also

Exceptions certainly exist, particularly in the civil service or in unionized workplaces (Anderson, Hegewisch, and Hayes 2015). However, if women in female-dominated occupations were to go into male-dominated occupations, they would often have similar or lower expected wages as compared with their female counterparts in female-dominated occupations (Pitts 2002). Thus, many women going into female-dominated occupations are actually situating themselves to earn higher wages. This holds true for all categories of women except for the most educated, who are more likely to earn more in a male profession than a female profession. There is also evidence that if it becomes more lucrative for women to move into male-dominated professions, women will do exactly this (Pitts 2002).

- A particularly depressing example is the well-publicized evidence of sexism in the tech industry (Hewlett et al. 2008).

- But research suggests that women are making a logical choice, given existing constraints.

- Even for women who go against the grain and pursue STEM careers, if employers in the industry foster an environment hostile to women’s participation, the share of women in these occupations will be limited.

- As female labor became a crucial part of the economy, efforts by the Women’s Bureau increased.

- But these adjusted statistics can radically understate the potential for gender discrimination to suppress women’s earnings.

Two-thirds of the American Geographical Society (AGS)’s employees were women, who served as librarians, editorial personnel in the publishing programs, secretaries, research editors, copy editors, proofreaders, research assistants and sales staff. These women came with credentials from well-known colleges and universities and many were overqualified for their positions, but later were promoted to more prestigious positions. Two years ago I was appointed to a promotions committee at a provincial university.

Entertainment

The term was coined in 1983 to describe the limits women have in furthering their careers since the jobs are often dead-end, stressful and underpaid. Pink ghetto was more commonly used in the early years, when women were finally able to work. Pink-collar work became the popular term once it was popularized by Louise Kapp Howe, a writer and social critic, in the 1970s.

In addition, Military nurses, an already „feminized“ and accepted profession for women, expanded during wartime. In 1917, Louisa Lee Schuyler opened the Bellevue Hospital School of Nursing, which was the first to train women as professional nurses.[20] After completing training, female nurses worked in hospitals or more predominantly in field tents. Social norms and expectations exert pressure on women to bear a disproportionate share of domestic work—particularly caring for children and elderly parents. This can make it particularly difficult for them (relative to their male peers) to be available at the drop of a hat on a Sunday evening after working a 60-hour week. To the extent that availability to work long and particular hours makes the difference between getting a promotion or seeing one’s career stagnate, women are disadvantaged.

Study Tools

Based on data collected as part of a broader participatory action research project on casual academic labor in Irish higher education, the article focuses on the intersection of precarious work and gender in academia. We argue that precarious female academics are non-citizens of the academy, a status that is reproduced through exploitative gendered practices and evident in formal/legal recognition (staff status, rights and entitlements, pay and valuing of work) as well as in informal dimensions (social and decision-making power). We, therefore, conclude that any attempts to challenge gender inequality in academia must look downward, not upward, to the ranks of the precarious academics.

Critics of this widely cited statistic claim it is not solid evidence of economic discrimination against women because it is unadjusted for characteristics other than gender that can affect earnings, such as years of education, work experience, and location. Many of these skeptics contend that the gender wage gap is driven not by discrimination, but instead by voluntary choices made by men and women—particularly the choice of occupation in which they work. And occupational differences certainly do matter—occupation and industry account for about half of the overall gender wage gap (Blau and Kahn 2016).

A Silent Workforce: The Feminization of the United Nations

In short, occupational choice is heavily influenced by existing constraints based on gender and pay-setting across occupations. Too often it is assumed that this gap is not evidence of discrimination, but is instead a statistical artifact of failing to adjust for factors that could drive earnings differences between men and women. However, these factors—particularly occupational differences between women and men—are themselves affected by gender bias.

Complicated travel arrangements had to be made each time for the 12 or so out-of-town members, and there were difficulties finding dates that were mutually compatible. Extensive documentation had to be collected and circulated, interviews arranged, referees contacted. At each meeting Pat, the secretary, not only took minutes but frequently left the room to make telephone calls and send faxes. Pat did all this cheerfully and was warmly thanked by members of the committee at the end for taking care of them. The work was secretarial in the broadest sense, including organizing lunches and daily travel arrangements, … In 1913 the ILGWU signed the well-known „protocol in the Dress and Waist Industry“ which was the first contract between labor and management settled by outside negotiators.

Despite the high visibility of the United Nations, little is known about the employment conditions of almost half of its workforce. The findings suggest that the United Nations is split in half; those appointed as “staff members” enjoy standard working conditions, while those hired as “non-staff”, such as consultants, interns and volunteers, are feminized. It is unclear if this feminization affects women and men equally as the United Nations keeps limited statistics on non-staff. Informal employment tends to affect women more than men, however, so it is likely that female non-staff are especially feminized. By applying the labour standards it sets for the rest of the world to its internal organization, the United Nations would benefit its workforce, boost its legitimacy and set a more general precedent in dealing with the increasing feminization of the workforce.

While women have increasingly gone into medical school and continue to dominate the nursing field, women are significantly less likely to arrive at college interested in engineering, computer science, or physics, as compared with their male counterparts. This paper explains why gender occupational sorting is itself part of the discrimination women face, https://accounting-services.net/the-rise-of-the-no-collar-job-what-schools-need-to/ examines how this sorting is shaped by societal and economic forces, and explains that gender pay gaps are present even within occupations. This article locates the reorganization of work relations in the apparel sector in Pakistan, after the end of the Multi-Fibre Arrangement (MFA) quota regime, within the context of a global production network (GPN).

Burn Rate: What It Is, 2 Types, Formula, and Examples

Content

On the other hand, negative cash burn rate metrics indicate that you’re building your cash reserves. Startup companies with positive cash flow during their early stages are relatively rare. They self-fund or seek venture capital, develop a product or service, and then build a sales pipeline. A solid base of initial funding increases the runway to build, but at some point any new company must create cash flow to sustain itself. You can use the burn rate calculation to quickly determine your company’s cash runway (how long your company can operate at its current rate before running out of cash). Cash burn rate takes total cash balance from the prior month minus the cash balance in the current month to determine your current cash burn rate.

- When your cash runway runs out, you’re out of cash and you’re out of time.

- If a business burns through its cash too quickly, it risks running out of money and going under.

- You can find all the information you need to measure burn rate on your cash flow statements.

- The key thing to remember when it comes to managing burn rate is that you should aim to spend efficiently without compromising on growth and future profitability.

- If the company has $100,000 in the bank, a good burn rate would fall between $16,667 (six months) and $8,333 (12 months).

- If you just underwent a successful round of funding, for example, your burn rate could be negative if calculated with venture capital or investment funding.

- The best way to calculate burn rate is over a quarterly, six-month or annual period.

This is more than just closing your wallet and not spending money. For example, if your company has a burn rate of $10,000 then that means you are spending approximately $10,000 per month in excess of your revenues. Some analysts argue that a more appropriate way to estimate cash burn is to ignore the cash from investing and financing activities and focus solely on cash from operations. However, that narrowed focus doesn’t seem prudent because most firms need to make capital expenditures to continue operating. To get control of your cash burn rate, you need to keep an eye on your cash flow.

Burn Rate

Established business also need to regularly monitor their burn rate if they are facing operating losses. It will assist management to evaluate their ability to continue as going concern and adopt measures for enhancing revenue. As a startup founder, you should review all expenses to see where you can make cuts and determine what is necessary vs. unnecessary to reduce costs and improve your burn rate. If you are a pre-revenue startup, you need to consider how much money you are spending to improve your burn rate.

- This may suggest that investors will need to more aggressively set deadlines to realize revenue, given a set amount of funding.

- Startups that have a lot of ambition and want to grow quickly use venture capital funding to help them do so.

- With it, you can easily keep track of your financials, bring forecasts up to date and easily review your cash burn rate starting with a cohesive view of every metric in your business dashboard.

- Scrap them and focus on more profitable streams or

put them on hold until you figure out how to make them work.

Operating expenses include expenses such as staff salaries, rent and administration costs. The gross burn rate shows how high a company’s total monthly costs are. It’s crucial to understand and calculate your company’s cash burn rate since it can determine whether or not you’ll be able to sustain your operations. Calculating cash burn rate is crucial for established companies and startups. It assists in forecasting future investments and identifies minimum income or loan amounts required to offset expenses.

The Two Key Metrics

And one in ten say late payments are threatening the viability of their business. Where you are in your growth journey will affect your decision making when it comes to establishing a target burn rate. Your burn rate will also help you figure out when to fundraise. https://www.bookstime.com/articles/accounting-for-research-and-development Grew from a 2-person startup to a NASDAQ listed public company. Our account management team is staffed by CPAs and accountants who have, on average, 11 years of experience. We set startups up for fundrising success, and know how to work with the top VCs.

It’s an important indicator of the financial health of your business. If you’re between statements and want to look at your burn rate for how to calculate burn rate the month, add up your expenses using bank and credit card statements. Revenue numbers should be registered in your accounting software.

Cash runway

Needless to say, this theory was dead wrong, and many startup finance experts have since changed their tune on how to handle burn rate. Airwallex US, LLC (NMLS # ) is licensed or authorized to do business as a money transmitter in most states. For some U.S. customers, Airwallex partners with Evolve Bank & Trust (member FDIC) to provide payment and banking services. Texas customers can click here for information about filing complaints about our money transmission or currency exchange products or services. To avoid late payments, ensure you invoice on time and continue to remind customers when their payments are overdue. If you sell high-value products or services, it’s a good idea to check your customer’s credit score before you deliver to ensure they can afford to pay their bills.

Read on to learn how to calculate burn rate, burn rate benchmarks, and more. If you’ve heard the phrase “burning cash,” then you likely already understand what burn rate means. Your payment processor, a money market account, a saving account, etc. all likely contain dollars that should be included in the analysis. Now that you’ve narrowed your product and service offerings, look at ways to increase revenue.

Contra Account Definition + Journal Entry Examples

Contents:

This allows for the easy determination of historical costs. This is particularly important for contra asset accounts. The difference between an asset’s balance and the contra account asset balance is the book value. Contra accounts play an important role in accounting by helping businesses track certain aspects of their finances more accurately.

Sometimes people encounter hardships and are unable to meet their payment obligations, in which case they default. The same thing happens to companies as well. Therefore, there is no guaranteed way to find a specific value of bad debt expense, which is why we estimate it within reasonable parameters.

Contra assets decrease the balance of a fixed or capital asset, carrying a credit balance. Contra liabilities reduce liability accounts and carry a debit balance. Contra equity accounts carry a debit balance reduce equity accounts. Contra revenue accounts reduce revenue accounts and have a debit balance. Contra asset accounts include allowance for doubtful accounts and the accumulated depreciation. A contra account offsets the balance in another, related account with which it is paired.

Do Contra Accounts Have Debit or Credit Balances?

Hence, the investing activities include value of the liability will be the credit balance of the liability account minus the debit balance of its contra liability counterpart. Pitt Corporation’s most recent balance sheet reports total assets of $35,000,000 and total liabilities of $17,500,000. Management is considering issuing $5,000,000 of par value bonds with a maturity date of ten years and a contract rate of 7%.

The shortest period would be your contract period, and the longest would be your customer’s life.” Selecting the timeframe for the amortization could be either the short or long goal post, depending on the business. Reserve for obsolete inventory is a contra asset account used to write down the inventory account if inventory is considered obsolete. Excess, stored inventory will near the end of its lifespan at some point and, in turn, result in expired or unsellable goods. In this scenario, a write-down is recorded to the reserve for obsolete inventory.

The investors paid only $900,000 for these bonds in order to earn a higher effective interest rate. Company A recorded the bond sale in its accounting records by increasing Cash in Bank , Bonds Payable and the Discount on Bonds Payable (debit contra-liability). Those who are struggling with recording contra accounts may benefit from utilizing some of the best accounting software currently available. By keeping the original dollar amount intact in the original account and reducing the figure in a separate account, the financial information is more transparent for financial reporting purposes.

And I know this is petty, but they are accounting principles. They don’t walk the halls of an elementary school, and they’re not deposited into a bank to earn interest. You can rationalize it all sorts of ways, and you’ve certainly tried, but simply listing a few accounting principles you heard about in Accounting 101 doesn’t justify ignoring others.

What is Bad Debt?

The contra asset account would be used to offset the equipment account on the balance sheet. This would give a more accurate picture of the company’s assets. For example, if the company purchased a computer for 1,000 and it had a five-year life expectancy using straight-line depreciation, the contra account would be debited for 200 each year .

UCLA and Cal athletics: Financial reports paint gloomy pictures, add context (for both) to the Big Ten situation – East Bay Times

UCLA and Cal athletics: Financial reports paint gloomy pictures, add context (for both) to the Big Ten situation.

Posted: Fri, 20 Jan 2023 08:00:00 GMT [source]

A contra expense account is a general ledger expense account that will intentionally have a credit balance . In other words, this account’s credit balance is contrary to the usual debit balance for an expense account. Make sure that you report contra accounts on the same financial statement as the related accounts.

Amortization of Discount on Bonds Payable

The accumulated depreciation account appears on the balance sheet and reduces the gross amount of fixed assets. Contra equity accounts are accounts in the equity section of the balance sheet that reduce the amount of equity a company holds. Equity accounts usually have a credit balance. Therefore, contra equity accounts have a debit balance to offset their corresponding equity balances. In finance, a contra liability account is one that is debited for the explicit purpose of offsetting a credit to another liability account. In other words, the contra liability account is used to adjust the book value of an asset or liability.

Allowance for Doubtful Accounts: Methods of Accounting for – Investopedia

Allowance for Doubtful Accounts: Methods of Accounting for.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

This would allow the company to track the amount of money that has been borrowed. The contra liability account would be used to offset the liability account on the balance sheet. A Contra liability account is an account that is used to offset another liability account on the balance sheet. Contra liability accounts are typically used for bonds, notes payable, and other indebtedness. An allowance for doubtful accounts is a contra asset account that is used to offset Accounts Receivable on the balance sheet.

This type of account could be called the allowance for doubtful accounts or bad debt reserve. The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected to be uncollectible. Key examples of contra accounts include accumulated deprecation and allowance for doubtful accounts. Note that accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean.

As speaker bid falters, mixed views of Kevin McCarthy in California hometown – East Bay Times

As speaker bid falters, mixed views of Kevin McCarthy in California hometown.

Posted: Fri, 06 Jan 2023 08:00:00 GMT [source]

It’s clear you do not have a strong understanding, nor an appropriate respect for, accounting principles and US GAAP. And honestly, there is no problem with that if it’s not a key part of your job. I’m warning others, as strongly as I possibly can based on my expertise and experience, to not heed your advice when it comes to applying US GAAP accounting principles . EITF’s are contained within the GAAP hierarchy as level 3 authoritative guidance and can only be nullified or modified by guidance issued at level 1 or level 2. Within GAAP, we still live in a rules based world. Maybe as we progress more towards IFRS or some other principles based standard, that may change, but it hasn’t yet. There is no way to footnote that you are applying an ASC or FIN or EITF in any way other than as prescribed.

This account helps to give a more accurate picture of the company’s financial position. This question is asked by many students, accountants, and professionals. This article will give you the definition of contra in accounting, talk about different contra accounts, and give examples. Outstanding SharesOutstanding shares are the stocks available with the company’s shareholders at a given point of time after excluding the shares that the entity had repurchased.

Accounts Receivable AccountAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. They are categorized as current assets on the balance sheet as the payments expected within a year. It can retire the shares, meaning that they will no longer be existent on the company’s financial statements as treasury stock.

- Adidas must pay $206,948 at maturity plus 20 interest payments of $8,000 each.

- Contra accounts are used to reduce the original account directly, keeping financial accounting records clean.

- Investopedia requires writers to use primary sources to support their work.

- For example, contra revenue accounts can be used to track the full cost of sales less any discounts or returns.

- The company would then have a contra liability account for the bonds.

- Just in case you wanted to run a report from your accounts, you can click thedrop-down▼ button on the Action column and then selectRun report.

Usually, https://1investing.in/ accounts, Revenue accounts, Equity Accounts, Contra-Expense & Contra-Asset accounts tend to have the credit balance. The discount offered on the liability created when a company borrows a specific amount of money and repays it early. Discount on notes payable reduces the total amount of the note to reflect the discount offered by the lender. DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

You may not need to use contra asset accounts right now, but as your business grows, using contra asset accounts will likely become a necessity. You don’t have to, yet even a small business will benefit by using the contra asset account for accounts receivable. This eliminates the need to write off large accounts receivable balances at year end since they’ve already been accounted for.

Contra accounts subtract from the value of a related account. G2’s Best Finance and Accounting Products awards show that spend management has entered the mainstream of accounting operations. Recognize revenue, which is either at a point in time or over time. The Structured Query Language comprises several different data types that allow it to store different types of information…

Do I Need an Accountant for Small Business? Top 10 Questions You Should Ask

Content

For example, you can tack on live bookkeeping to your Intuit QuickBooks Online software for as little as $200 per month. Knowing your budget might also help to answer my previous question. As you search for an accountant, consider how much you’d like to spend on accounting services. Budgeting also falls within a small business accountant’s wheelhouse.

Do I Need A CPA For My Small Business? – Forbes

Do I Need A CPA For My Small Business?.

Posted: Fri, 20 Jan 2023 08:00:00 GMT [source]

By working together closely and communicating openly and honestly, you can be sure that you’re using their expertise to help you make the best decisions for your business’ success. Make sure they have excellent communication and customer service skills, without leaning too much on technical jargon. Doing your own accounting can take six or more hours to do every month which adds up to almost two full nine 8-hour work days over the course of a month. Here, we’ll break down the reasons why you may need an accountant, and how to go about finding one who’s a good fit for your business.

Minimize the Risks of Business Activities

The right candidate should take accountability for their mistake and explain how they did what was necessary to make it right. Explore product experiences and partner programs purpose-built for accountants. Or would you rather have someone who can just give you the top line summaries when you need it?

Another option is utilizing the American Institute of CPAs’ directory or the National Association of State Boards of Accountancy, which allows users to search by state and region. For example, they can check whether the company’s assets are fully owned or leased or part-paid for, and whether the company has any outstanding debt. Only you can decide whether you then want to take on the franchise or not.

How Many Weeks Are In A Payroll Year: A Quick Overview Of Payroll Periods

Stop wondering how to hire an accountant for a small business—we’re right here! Milestone Business Solutions offers accounting and bookkeeping services to clients of all sizes with competitive monthly rates that are affordable. We believe in developing true partnerships with our clients, and provide each and every one of our partners a unique approach to their accounting needs. We make life easier for small business owners while helping them grow successful businesses.

- For smaller businesses, it can be tempting as the owner to try filling out all the tax forms and making payments yourself, without seeking advice.

- Check for experience, personality traits, and digital software expertise thoroughly.

- Expense management software, numerous accountants are embracing innovation.

- CPAs thoroughly understand the GAAP , which involves revenue recognition, balance sheet classification, and materiality.

- When you’re interviewing potential accountants, ask them about the type of accounting software they’re comfortable using and what they do to stay up to date with the latest accounting and tax laws.

Unless you’re expecting a windfall refund, tax season tends to be stressful for most small business owners——especially if you haven’t kept your records current. In addition to the work of getting all your information up to date, there’s also the worry of an audit or penalty for late filing. An accountant can give you peace of mind that your taxes are done correctly, provide thorough tax planning to maximize deducitons, and will provide necessary support should you be audited. Whether you’re in the scribbling-on-a-napkin planning stage or you’ve already started operations, having an accountant could save you time and money down the road. But beyond the importance of having a skilled accountant, you also need a staff you can rely on. Sign up today and get helpful recruiting advice for your business and information on the current hiring market and HR trends.

Keep with Tax Laws and Maximize Tax Savings

An how to find an accountant for small business will best be able to tell you what’s allowable, and what’s not. Are you aware that many small business owners simply file their personal and business taxes together, in one return? These types of businesses are referred to as “pass-through” entities. In late 2017, the Trump administration introduced the Tax Cuts and Jobs Act . Although there are certain restrictions, the TCJA allows for a new tax break for small business pass-through entities, equivalent of up to 20% of its income.

- Once you’ve found your new accountant, you want to ensure you get the most out of your relationship.

- If you do, and the IRS wants to take a look at your books, then maybe you need a CPA.

- With numerous accounting services being offered online, many experts agree that virtual CFO services for small businesses are crucial for companies aiming for expansion.

- That means taking risky actions that have financial consequences, many of which are unforeseeable.

- Providing advice on how to track expenses during your daily business activities.

- The level of onboarding can vary depending on the accountant’s experience.

How to create a property purchase journal entry from your closing statement

Contents:

Next, you should use the “Asset Account” from the drop-down menu to select the asset account that should be used when tracking the value of said asset. You can add more accounts if you need to track other types of transactions.Here are different account types you can add to your QuickBooks chart of accounts. Last year I worked with a bookkeeper who convinced me to track rent/expense differently than what I was doing .

As fixed assets, leasehold improvements can also be depreciated or amortized. Leasehold improvements provided by the landlord would be depreciated in the same way other assets are. However, leasehold improvements completed by a tenant would be amortized rather than depreciated.

These allowances often pay for costs incurred when a tenant moves to the new property, such as updating floors or windows. Several expenses normally deductible on an investor’s Schedule E frequently appear on the closing statement. These include property taxes, prepaid mortgage interest, assessments from an HOA, and insurance.

Work carried out when an asset “breaks” or before, so long as the work is carried out to restore the asset to the original condition. This includes action taken to prevent further deterioration and to replace or substitute a component at the end of its “useful life”. A maintenance task cannot be deemed a repair if it improves upon that original condition.

Useful Life

The following table summarizes many of the factual considerations used by the courts. These factors, although not exhaustive, should be considered in your analysis to distinguish between capital expenditures and deductible repairs. 2.) Depreciation Expense realizes the depreciation expense of the asset to your business’s profit & loss.

Fittings include removable items such as mirrors, lights and art. For example, land valued at $20,000 and buildings/improvements valued at $80,000 would give a ratio of $80,000/$100,000 or 0.8. Dawn Aldridge has worked in accounting and business since 2004. Her diverse experience includes public, small business and government accounting, as well as logistics and inventory management. She holds an MBA from the University of Illinois at Springfield.

How to record a property improvement that was paid for by the property manager

This can range from machinery and vehicles to any other fixed item used in a business’s operational quest for revenue. It is important to keep a record of fixed assets purchased, as the tax implications may be different for working assets. Leasehold improvements, also called “build out” expenses, are improvements made to space rented for your business that will be used exclusively by your business. Leasehold improvements can be minor changes, such as painting or flooring, or major changes, such as constructing, moving or removing walls.

Intuit (INTU) Q2 2023 Earnings Call Transcript – The Motley Fool

Intuit (INTU) Q2 2023 Earnings Call Transcript.

Posted: Thu, 23 Feb 2023 08:00:00 GMT [source]

Even though many https://bookkeeping-reviews.com/hold improvements are actually tangible assets, such as carpeting or cabinetry, the tenant records the expense for these improvements with amortization. Since the landlord retains ownership of the improvements at the end of the lease, there is no salvage value for the tenant. Therefore, the leasehold improvements are treated as intangible assets and accounted for with amortization. Afixed asset can be considered a tangible item that a business owns and uses to generate income.

Full Reimbursement on an Insurance Claim

A capital improvement is a durable lasting upgrade, adaptation, or enhancement of the property which significantly increases the value of the property. The owner of Store A decides to lease space through Company B. The store only has four walls and no other amenities. Through the lease negotiation, Company B—the landlord—agrees to install shelving, a service counter for cash registers, and a display unit with special lighting before Store A opens its doors. The Coronavirus Aid, Relief, and Economic Security Act made some tweaks to qualified improvement property when it was passed in 2020. The act put a 15-year recovery period for QIP and allowed filers to claim first-year depreciation for any QIP. When you go to ‘write checks’ from the banking menu, you can see two tabs under ‘memo’ box – one is ‘expenses’ and the other is ‘items’.

Technically, you are amortizing leasehold improvements rather than depreciating them. The reason is that the landlord owns the improvements, so you are only exercising an intangible right to use the improvements during the term of the lease – and intangible assets are amortized, not depreciated. That’s why businesses periodically transfer a capitalized cost’s portion on the balance sheet to an expense on the income statement. The best way to record the purchase of a fixed asset in QuickBooks is to use the closing documents from the sale. It is often called a HUD statement (because the U.S. Department requires it of Housing and Urban Development). Whatever you call it, what you need for accounting purposes is the breakdown of any money transferred during the transaction.

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

Input the account’s name, then tick the Track depreciation of this asset checkbox. They are also subject to wear & tear , which decreases their value over time. It’s a relatively permanent resource of a company used in business operations to generate income, unlike parts of the inventory for reselling. QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts.

Once you select the fixed asset item you created for this purchase, QuickBooks will automatically enter the purchase amount into the check. Note that you can select more than one fixed asset item for the same purchase. These fixed assets are any additions and upgrades you make to leased assets or rental property. Such assets include built-in cabinets, interior walls, ceilings and any electrical and plumbing upgrades. While payment of tenant improvements is a negotiated deal, ownership is usually determined by the terms of the lease agreement. Nearly all commercial net leases state that the tenant improvements become the landlord’s assets upon completion.

what are payroll deductions and when do they happen the depreciation for the year as an increase to the leasehold improvements accumulated depreciation account. If you are not certain how to record capital improvements or calculate depreciation, hire an accounting professional to assist you. Purchase depreciation calculation software for easy calculation of annual depreciation expense for all fixed assets.

As you know, my clients, both commercial and residential real estate investors, have high standards for their real estate investments. With your service I have the ability to respond to their needs accurately and in a timely way. By booking fixed assets throughout the year you’ve now exponentially cut down on the time required at year-end to search for possible items that might be fixed assets. Your CPA will also greatly appreciate it to and so will your bank account for that matter.

How Bright Peak Therapeutics Built their Procurement Process from the Ground Up

Use clearing accounts when you cannot immediately post payments to a permanent account. For example, if you are furnishing a new building for a client, you may place costs and payments in a clearing account until the work is complete. If checks must clear and you have the cash to deposit in the bank , you may add the amounts to a clearing account. Below are the most frequently asked questions concerning fixed asset accounting, as well as the concise, clear answers you’re seeking. Forget insurance recordkeeping requirements when recording and tracking fixed assets.

We can show you how to add assets in QuickBooks Online and walk you through the process of making use of the software for bookkeeping. Our team of experienced accounting professionals can help you keep your software up-to-date to avoid unwanted issues with the IRS. Gita is well-known for her exemplary leadership and advisory skills. In fact, she even helped pioneer the adaptation of QuickBooks to suit the needs of professionals in real estate and property management. To share her knowledge she has written a series of courses titled Simplified Accounting Solution, which provides step-by-step guidance for those working with QuickBooks.

If you originally paid this expense out of pocket and have not previously recorded it, add the amount to owner’s equity. Tangible assets are physical assets, such as land, buildings or equipment. Depreciation is calculated using the useful life of the asset and the salvage value, or the amount for which the asset can be sold at the end of its useful life. To start tracking your fixed assets, click the Item button at the bottom of the list and add the details for each asset. According to Dictionary.com, a Fixed Asset is a permanently owned item.

I use my books personally so I think the property is a current asset, mortgage is a long term liability , I’ve read about the accumulated depreciation… in this case would it be appreciation? Then there’s the expenses of the purchase; wiring fees, escrow fees, document fees… so many fees LoL. The journal entries to record the incentive, the leasehold improvements, the amortization of the incentive and the lease payment for the first 6 years under the initial lease are the same as above. Construction work-in-progress assets are unique in that they can take months or years to complete, and during the construction process, they are not usable. If a company does not track these costs accurately, its finance department may wonder why the company is generating expenses that do not immediately produce profits. Accountants do not begin tracking depreciation of construction-in-progress assets until the addition is complete and in service.

In the From QuickBooks tab, you need to click on “Automatically” when QuickBooks Fixed Asset Manager opens and both new and modified fixed asset items. One easy way to work with your accountant is by using anAccountant’s Copy, which QuickBooks Desktop will produce for you. You can save the accountant’s file locally and share it electronically using a file transfer service. Then, your accountant can review and make changes directly to the accountant copy data, which then can be incorporated into your company file. As an alternative, your accountant can use the Send Journal Entries feature if they’re using an accountant’s version of QuickBooks.