Home » Forex Trading

Category Archives: Forex Trading

Create, Backtest, Refine and Perfect Trading Strategies with TrendSpider Strategy Tester

Contents:

As a provider of educational courses and trading tools, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole. To learn how to use Python for backtesting a trading strategy, check out this highly recommended video on How to use Python for Trading and Investment.

The simulation is run using historical data from stocks, bonds, and other financial instruments. The person facilitating the backtest will assess the returns daily treasury bill rates data on the model across several different datasets. Backtesting involves applying a strategy or predictive model to historical data to determine its accuracy.

Backtest the Strategies

This will save the results to user_data/backtest_results/backtest-result-.json, injecting the strategy-name into the target filename. There will be an additional table comparing win/losses of the different strategies (identical to the „Total“ row in the first table). Detailed output for all strategies one after the other will be available, so make sure to scroll up to see the details per strategy. While backtesting does take some assumptions about this – this can never be perfect, and will always be biased in one way or the other. To mitigate this, freqtrade can use a lower timeframe to simulate intra-candle movements. One big limitation of backtesting is it’s inability to know how prices moved intra-candle (was high before close, or viceversa?).

Moreover, it is essential to test if the chosen strategy is compatible with the current trading models of the market and if it will perform the same and give profitable results. A trading strategy may be effective during a bearish market but if it is applied in a bullish market it may not have the same performance and vice versa. Since the backtest mechanism is using historical data to check various strategies, the results may not always be accurate. This is why some of the past data may not fit the future or current demands of the market. As an example, consider testing a strategy on a random selection of equities before and after the 2001 market crash.

They have a replay function that I know some of our members have used and been happy with. Tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. Tastytrade and Marketing Agent are separate entities with their own products and services.

Portfolio Backtesting

That is, you use the universe that has survived until today to backtest. If you are satisfied with the backtesting strategy performance, then you can start paper trading. If not, you should tweak the strategy until the performance is acceptable to you. And once the paper trading results are satisfactory, you can start live trading.

Backtesting will not help you develop a strategy but rather find one that is proven successful. Having said that, you must backtest a strategy several times before you apply it in the live market. This is a crucial factor for the effectiveness of backtesting. Trading Strategies Learn the most used Forex trading strategies to analyze the market to determine the best entry and exit points. Backtest is an efficient procedure that helps traders to spot the weak points of their chosen strategy, test its adaptability, and adjust it to their needs without any risk involved. Of course, when a trader decides to backtest a strategy his main concern is to use impartial data to extract reliable and transparent conclusions.

Why is Backtesting Important to Traders?

When implementing any trading strategy, it’s important to take the necessary steps to manage your risk. Even in a simulated environment where there’s only virtual funds to be profited and lost, it’s vital to get exposure to positions that suit your risk appetite. QuickAFL is a feature that allows faster AFL calculation under certain conditions. Initially it was available for indicators only, as of version 5.14+ it is available in Automatic Analysis too.

But simply because their trading decisions are not based on sound research and tested trading methods. Think about it, before you buy anything, be it a mobile phone or a car, you would want to check the history of the brand, its features etc. The same principle applies to trading, and backtesting helps you with it.

Manual backtesting of a trading strategy

Ultimately, this could lead to a strategy that has been designed to make a profit over the backtesting period, but it could largely be ineffective under normal trading conditions. Backtesting involves determining how a strategy would have performed in the past. However, historical data alone is not enough to establish the viability of a trading system. Customise backtesting parameters to meet your specific needs to get accurate results. The parameters can include position sizes, margin requirements, and transaction costs.

How can I backtest for free?

There are some free as well as paid software available in the market for backtesting a trading strategy. Some of the free backtesting software are Microsoft Excel, TradingView, NinjaTrader, Trade Station, Trade Brains, etc.

Since the backtest technique can be done by automated software, traders can try to utilize more than one strategy at the same time and compare the results instantly. How to find new trading strategy ideas and objectively assess them for your portfolio using a https://day-trading.info/ Python-based backtesting engine. In particular, Yahoo Finance data is NOT survivorship bias free, and this is commonly used by many retail algo traders. One can also trade on asset classes that are not prone to survivorship bias, such as certain commodities .

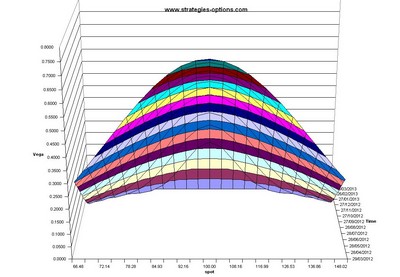

The graph above shows a timeline of how a backtesting model could become flawed due to look-ahead bias. The model assumes that information becomes available at points A and C, while in reality, the information becomes available at points B and D. The result of a properly constructed backtest would likely yield an entirely different result than the one that makes the same assumptions as above. Backtesting works as a method of establishing the viability of a trading strategy.

How do you backtest a model?

Backtesting a risk model, for instance, is typically done by checking if actual historical losses on a portfolio are very different from the losses predicted by the model. If actual losses are consistently higher, the model is underestimating risk. If they are lower, the model is overestimating risk.

For illustration, we will demonstrate how to backtest a trading strategy in Python in the next part of this article. The final step is to decide the programming language which you will use to backtest a trading strategy. Actually, it is a matter of personal choice and the language you are comfortable with.

So if you chose to sell a put by clicking on the bid column, click on the ask column and it will remove the short contract. Upon entering the symbol, you will be able to see the various expiration cycles populated in the “Chain” tab. Here you can select the duration you would like to backtest by looking at the “X DTE” in the parenthesis next to each of the expiration dates. You collate the performances of all the out-of-sample data from year 4 to 10, which is your out-of-sample performance. A portfolio with beta 1 means the portfolio has the same volatility as the market.

- Detailed output for all strategies one after the other will be available, so make sure to scroll up to see the details per strategy.

- Backtesting is determining how a trading strategy would have performed in the past.

- For example, if a broad market system is tested with a universe consisting of tech stocks, it may fail to do well in different sectors.

- The output will show a table containing the realized absolute Profit for the given timeperiod, as well as wins, draws and losses that materialized on this day.

- Thus, there might be situations where you include future data that was not able in the time period being tested.

For more experienced traders that also have the technical knowledge to develop their own backtest parameters, there is a variety of coding libraries, that they can use to write a backtest script. Thus, using Python, C++, C#, and other languages a trader can develop a backtesting script due to his trading logic. Sometimes, investors may use a simple technical analysis tool combined with an indicator and some historical data to create a chart and monitor simple statistics. Moreover, a trading portfolio embodies various strategies that have different characteristics, strengths, and weaknesses.

The prices must be stored in a MATLAB® timetable with each column holding a time series of asset prices for an investable asset. Generally, it depends on the type of your trading style and the periods you plan to hold your positions for. For example, if you are a long-term trader, then you better backtest your strategy for a period of 5-15 years. Otherwise, short-term traders can use shorter time frames of weeks or months. Before making an investment decision, you should rely on your own assessment of the person making the trading decisions and the terms of all the legal documentation. Last but not least, a very crucial factor for traders to keep their investments safe is to define the level of dependence on their assets’ success.

Ray Dalio: How To Backtest Your Investments – The Acquirer’s Multiple

Ray Dalio: How To Backtest Your Investments.

Posted: Sun, 19 Feb 2023 08:00:00 GMT [source]

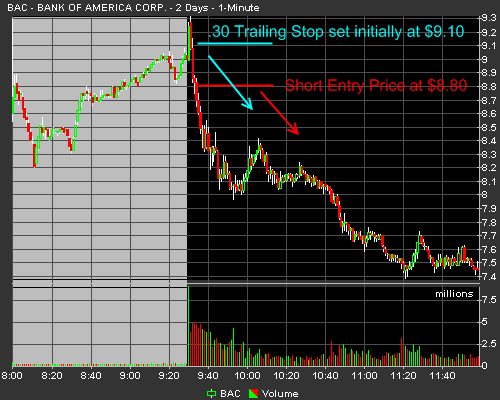

The simplest backtest includes looking at one-minute or five-minute chart timeframes, for example, of the asset being traded. You could find prior trades based on that strategy and then add up the profits and losses, which would provide an idea of the profit produced that week. Backtesting is a manual or systematic method of determining whether a trading strategy or concept has been profitable in the past. There are different methods to backtest trading strategies on MT4. The first and most recommended method is to use the strategy tester tool on a risk free paper trading account.

Can you backtest on TradingView for free?

you can do charting create alerts create strategies and of course, you can do backtesting. Now there are a couple of reasons why we are using the trading view. Number one is that it's free.

fasb vs gasb: Major Differences Between US GAAP and IFRS

Contents:

The London-based International Accounting Standards Board , founded in 2001 to replace an older standards organization, is responsible for the International Financial Reporting Standards , which are now used in many countries throughout the world. In recent years, the FASB has been working with the IASB on an initiative to improve financial reporting and the comparability of financial reports globally. The FASB authorizes the financial accounting guidelines for the public and private companies in the U.S. It is recognized as reliable by the Securities and Exchange Commission . The FASB essays to enhance financial accounting and reporting practices that may augment the Market Efficiency by rendering more obvious, authentic and comprehending information to the users and investors. The International Accounting Standards Board and the Financial Accounting Standards Board both work towards the aim of growing and enforcing monetary reporting standards for publicly held companies.

- However, now all GAAP resides in the ASC so the FASB and EITF do not issue new standards but rather updates to the Codification.

- Indian GAAP requires separate disclosure of exceptional and non recurring items.

- The Financial Accounting Standards Board is a private, non-profit organization standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles within the United States in the public’s interest.

- Disclosure of earnings per share and reporting of segments, and interim, annual, and periodic filing requirements as per the guidelines of the FASB-ASC and the SEC, respectively.

- The American Institute of Accountants, which later became AICPA created a special committee to work with NYSE to establish standards for accounting procedures.

IFRS does not prescribe any format, but stipulates minimum line items like PPE, Investment property, Intangible assets, Financial assets, Biological assets, inventory, receivables etc. Additional line items, subheadings and subtotals shall be presented on the face of BS if relevant. The order of presentation within the group or otherwise in not mandatory. The Accounting Standards Board and the Auditing and Assurance Standards Board , assist the ICAI in setting standards.

Who is the focus of the financial account standards board – FASB?

The many favorable responses to prior editions from both students and instructors confirm our belief that clear presentation and comprehensive illustrations are essential to learning the sophisticated topics in an advanced accounting course. When it comes to intangible assets, IFRS takes into account whether an asset will have a future economic benefit as a way of assessing the value. Intangible assets measured under GAAP are recognized at the fair market value and nothing more.

They can work at a public accounting firm or at the internal audit department of a business. Tax accounting refers to the process of preparing tax returns and ensuring compliance with tax laws and regulations for businesses. The primary aim of cost accounting is to identify key business areas where costs can be reduced to increase profitability.

The Different Types of Accounting

The cost-benefit analysis is an important guideline while making an amendment. The cost, here, means the cost of educating and implementing the change. The benefit means how much the amendment shall increase the relevancy and transparency for the users of financial information. With that stated, the user’s benefit is highly regarded by financial account standards board . The Financial Accounting Standards Board is an independent and non-profit organisation that contains 7 members of the government body.

Banking was quite developed in ancient Greece Bankers kept account books, changed and loaned money, and even arranged for cash transfers for citizens through affiliate banks in distant cities. Review the combined statement of revenues, expenditures, and changes in fund balances. GAAP pronouncements into roughly 90 accounting topics and displays all topics using a consistent structure.

They work in-house at a business, at a public accounting firm, or as part of a government agency. Financial analysts implement accounting standards to help businesses make informed decisions. They can work in-house at a company or at a financial institution and specialize in areas such as budgeting, forecasting, or investment analysis.

Courses on Finance

The audit report and basis of presentation note will refer to compliance with “IFRSs as adopted by the EU”. Currently, the EU has adopted all IFRSs, though one aspect of IAS 39 was modified. The modification affects only a tiny percentage of EU companies following IFRSs. Financial accounting requires detailed information on the accounting framework utilized by the user of a company’s financial statements, such as Generally Accepted Accounting Principles or International Financial Reporting Standards . Statements of Position , which provides guidance on financial reporting topics until the FASB or GASB sets standards on the issue.

- It is designed to ensure that all current tax rules are followed by nonprofit organizations, businesses, and individual taxpayers.

- The key strengths of this text are the clear and readable discussions of concepts and the detailed demonstrations of concepts through illustrations and explanations.

- IFRS is a globally adopted method for accounting, while GAAP is exclusively used within the United States.

- Instead, the FASB participates in the Accounting Standards Advisory Forum, a worldwide grouping of standard-setters, and displays individual initiatives to hunt comparability.

- The primary aim of cost accounting is to identify key business areas where costs can be reduced to increase profitability.

Accounting standards have historically been set by the American Institute of Certified Public Accountants subject to U. The AICPA first created the Committee on Accounting Procedure in 1939 and replaced that with the Accounting Principles Board in 1959. Other organizations involved in determining United States accounting standards include the Governmental Accounting Standards Board , formed in 1984; and the Federal Accounting Standards Advisory Board , formed in 1990.

While the Codification does not change GAAP, it introduces a new structure4one that is organized in an easily accessible, user-friendly online research system. The primary authority is the Financial Accounting Standards Board , who releases regular statements, keeps meticulous archives, and offers helpful resources for companies and accountants looking to adapt to GAAP. The board is personal and non-governmental, however works for the general public’s finest curiosity. GAAP governs the monetary preparation and reporting by corporations and represents the rules that publicly-traded firms should adhere to when reporting their monetary info. GAAP consists of standards for a way U.S. firms should report their income statement, stability sheet, and assertion of money flows.

24 years old Early Childhood (Pre-Primary School) Teacher Charlie from Cold Lake, has several hobbies and interests including music-keyboard, forex, investment, bitcoin, cryptocurrency and butterfly watching. Is quite excited in particular about touring Durham Castle and Cathedral. Instead, the FASB participates in the Accounting Standards Advisory Forum, a worldwide grouping of standard-setters, and displays individual initiatives to hunt comparability.

FASB vs. IASB

Some of the variations between the 2 accounting frameworks are highlighted below. The FASB is acknowledged by the Securities and Exchange Commission because the designated accounting commonplace setter for public firms. FASB standards are recognized as authoritative by many other organizations, including state Boards of Accountancy and the American Institute of CPAs . In the sector of accounting there two primary regulatory boards which oversee the event of accounting standards for many countries across the world together with the United States and the European Union. One of the main standards agencies is named The International Accounting Standards Board . The IASB works to develop requirements and accounting procedures for more than 100 nations together with the United States.

The fasb vs gasb aims to develop a single set of high quality global accounting standards that require transparent and comparable information in general purpose financial statements. Due to operational problems of the earlier board , the Financial Standards Board was established in 1973 for development of accounting standards. FASB is an independent body relying on Financial Accounting Foundation for selection of its members and receipt of budget. FASB is supported by sale of publications and fees assessed on all public companies based on their market capitalization. The FASB staff can issue implementation guides and staff positions ,which are category D GAAP.

Friday Footnotes: KPMG’s ESG Conflict; PwC Fails to Deliver; FASB Turns Attention to AI 3.3.23 – Going Concern

Friday Footnotes: KPMG’s ESG Conflict; PwC Fails to Deliver; FASB Turns Attention to AI 3.3.23.

Posted: Fri, 03 Mar 2023 22:00:23 GMT [source]

Sample Answer – I have https://1investing.in/ed general transactions using ABC accounting software with emphasis to follow GAAP revenue recognition principles. Also at month end or closing, I was responsible to prepare trial balances and check the overall system for discrepancies and prepared adjusting entries at relevant intervals. I had assisted the CPA in preparation of the financial statements, closing accounts and post-closing trial balance to prepare the books for the next cycle. You must also discuss about the transaction you were doubtful about and how you would research the proper GAAP rules by referencing the codification and discussing it with your supervisor . In case you do not have any accounting experience then you must talk about the GAAP rules used how you learned to solve problems or about and also how you did some financial statement project where you had to use GAAP rules. It’s comprised of seven full-time members, who’re in turn monitored by a 30-person Financial Accounting Standards Advisory Council .

Highest Probability Candlestick Patterns

Contents:

The four candlesticks are the bullish engulfing candlestick, bearing engulfing candlestick, hammer reversal candlestick, and doji candlestick. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. A Piercing line candlestick pattern is a two-day bullish candlestick reversal pattern that appears in a downtrend. It signals a potential short term reversal from downwards to upwards.

Bullish harami represents two candles pattern, where the first candle is a significant bearish candle, and the second is a small bullish candle and usually indicates a future rising trend. This means that the second candlestick overshadows the first candlestick. In such an instance, you notice this type of candlestick pattern gains a formation at the level of resistance or where you have perceived a downward trend line; then, it is time to engage in selling.

The triple top is defined by three nearly equal highs with some space between the touches, while a triple bottom is created from three nearly equal lows. Generally, the wider the gap between touches the more powerful the pattern becomes. The double top/bottom is one of the most commonreversal price patterns.

A lot of traders feel they aren’t too different from an animal on the Sahara hunting their pray. Just like the hunting animal knows there are certain environments where they are more likely to score their next meal the trader favors certain set ups before entering a trade. This article will walk you through the environment on the charts that will yield the higher probability candlestick set-ups. You will also be introduced to merging pivot lines that work well with candlestick charting. Once you click on a link, you will be taken to a page describing the candlestick. The glossary defines the terms used on the individual candlestick pages, but the black arrow on the figure shows which way price usually moves after the candlestick pattern ends.

Pattern Strength: Weak

Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Below you’ll find the ultimate database with every single candlestick pattern . Here there are detailed articles for each candlestick pattern.

And similarly, when a bearish Marubozu formation occurs within the context of a declining price leg, it is more significant than one that occurs within the context of a rising price leg. Here we’ve shown both the bullish variation of the Marubozu candle in green, and the bearish variation of the Marubozu candle in red. Essentially, the bullish Marubozu candle opens at or near the lower end of the structure and closes at or near the upper end of the structure. The bearish Marubozu candle opens at or near the upper end of the structure and closes at or near the lower end of the structure. The shooting star pattern can provide for a solid shorting opportunity, as many markets tend to fall much faster than the rise. As such, it can be a very profitable pattern to trade when the right conditions exist.

Although the sample sizes used in producing these statistics are usually in the thousands, there will be significant variability in winning percentages between subsets of the sample. All results will vary somewhere between the worst group of 20 and the best group of 20. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

The best option trading strategies is the long Call and long Put strategies. The long call strategy profits if the stock price is above the strike price at expiration. At the same time, the long put strategy profits when the stock price is below the strike price before the expiration.

What is a Marubozu candlestick pattern and how to trade it?

If you want to know if a candlestick pattern is a signal of a trend reversal, consider other factors such as indicators, price zones where the candlestick pattern appears, etc. Sometimes, it appears only as a pullback of price during a mainstream trend. On the contrary, the reversal pattern, signaling a continuation signal, is a very good signal to trade. This type of pattern is recognized for applying the usage of two candlesticks. The first candlestick application is noted as being bearish, while the application of the second candlestick is considered bullish.

It is represented with a long wick candle after a bullish trend. In terms of a candlestick pattern that is bullish engulfing, it is noted that this is in direct opposition to the candlestick pattern that is bearish engulfing. In such cases, this pattern is formed within a downward trend of the support sector; then, this trend could be switched over to a movement in the upward direction. Financial chart used to describe price movements of a security, derivative, or currency using price low, high, close, and open for some time (5 minutes, H1, H4, daily, etc.). Bearish and bullish patterns mean that some patterns indicate a future rising trend, bullish, or future downtrend, bearish. The Marubozu candlestick pattern is a single candle formation which is considered a continuation pattern.

Three White Soldiers Candlestick Pattern

The second one is a small candle with a negligible body and very little wicks. The third one is a bullish candlestick that suggests a turnaround in the market bias. The bullish candlestick doesn’t always have to be as big as the first bearish candle.Three White SoldiersMade up of three bullish candlesticks with little or no wicks. This often suggests a bullish continuation.Three Inside Up HaramiMade up of three candlesticks – a bearish followed by two bullish ones.

Angeles Investors Announces Funding For Latina Owned Booming Frozen Packaged Food Line, MasPanadas – Benzinga

Angeles Investors Announces Funding For Latina Owned Booming Frozen Packaged Food Line, MasPanadas.

Posted: Wed, 01 Mar 2023 11:11:00 GMT [source]

And most importantly, we can see that the candle closes within the upper one third of the price range. Usually, the harami candlestick pattern can also be considered to be the inside bar pattern. When the stock breaks above its neckline, that triggers a buy signal for traders, with a stop loss level being set near the neckline breakout level. A double bottom is a bullish reversal pattern that describes the fall, then rebound, then fall, and then second rebound of a stock.

Hhttps://forexhero.info/ her timeframes have slightly better performance than the H1 chart time frame. The candlestick pattern that is bearish engulfing is a pattern that engages in the application of two candlesticks. It is noted that the application of the first candlestick is determined to be bullish. However, the second candlestick application is determined to be bearish, demonstrating an ultimate change in the market’s sentiment.

However, if any other criteria were used, it is likely that this pattern would be considered a loser, as candles D through G continued the downtrend, breaking below the lows of the piercing pattern. Once again, candles A and B represent a piercing pattern at the bottom of a downtrend. If the winning patterns were determined simply by the next candle following through to a profit , then the pattern is classified as a win. The historical probability of pattern success is unlikely to match the future probability. If you want to use published win percentage results, plan for worse performance in your live trading. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn.

Pattern Type: Reversal

Use this price development to minimize your risk and trail your stop-loss level accordingly. You have to place a stop-loss just below the low of this long-body candle. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Usually, at the start of the London and New York session, the forex market will start with strong impulsive waves. But, since nothing moves in a straight line, the price will often pull back giving us another opportunity to enter the market. Using high probability forex trading strategies has enormous advantages for trading psychology. A common anomaly in the charts is when there is a gap in Forex prices. But even in this case, there are trading opportunities for those who know how to interpret them.

Statistics to prove if the Down-Gap Side By Side White Lines pattern really works What is the… The upside gap three methods candlestick pattern is a 3-bar bearish continuation pattern.It has 2 green candles and a red one.The second candle gaps above the first one. Statistics to prove if the Upside Gap Three Methods pattern really works [displayPatternStats…

The shooting star is a reversal single candlestick formation that is often seen at the end of an up trending market environment. In addition, the shooting star also occurs at the termination of the corrective phase within a larger down trending market move. Below you can also take a look at the summary of already mentioned candlestick patterns, as well as some more candlestick patterns that can be effectively used in forex trading.

Also, finding them at https://traderoom.info/ or resistance can give you a heads up on direction change and offer an edge in your trading. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. The three white soldiers candlestick pattern is a 3-bar bullish pattern.It has 3 long green candles, each making new higher high.Each candle’s body should be approximately the same size. Statistics to prove if the Three White Soldiers pattern really works… The up-gap side by side white lines candlestick pattern is a 3-bar bullish continuation pattern.The first and second lines are separated by a bullish gap.

When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accuhttps://forexdelta.net/, timely, useful, or reliable. The Doji candlestick to can be seen as a relatively small structure that appears to have a small body and shadows of relatively equivalent length on either side. These shadows would generally be larger in length than the body of the candle. The Doji candle can either close up, close down, or close at the exact same price. This is also a good entry technique, because, after the completion of the hammer formation, prices will often retrace a portion of its structure before resuming to the upside.

When you notice this pattern in such cases, it is time for you to engage in selling. The price dynamics within the Doji candlestick suggest that the market is experiencing an indecision phase. This indecision phase can be seen by the prices meandering higher and lower, but closing near the opening price of the candle. As such, neither the bulls nor the Bears are in control during this candle formation. Instead, the market appears ambivalent as to where the next price leg is likely to go. The chart above displays a down trending market condition, which ultimately leads to a hammer candle formation near the bottom of the price range.

- Engulfing can be said to be a very powerful price signal in many types of markets.

- We research technical analysis patterns so you know exactly what works well for your favorite markets.

- The first bearish candlestick after the bullish one is small compared to the previous bullish candlestick.

- You usually see this after a parabolic move up (or down in a down-trend).

If the stock had a big down move before the descending triangle, there is a high probability it will fall through the support zone. If you don’t know the best ways to find support and resistance zones, we show you the most relevant ways in our free trading guide here. When I see a high volume move, I will always look for a pullback because chances are, that it will move even higher. If you see heavy volume after a stock already moved up big, it could indicate that the price may have reached the top.

In the chart above, the bullish engulfing candlestick engulfs the previous five trading sessions, signifying the likelihood that stocks are on track to move higher. Trading in the direction of the trend is not always a given as key levels of support/resistance can indicate a reversal. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. This candle formation includes a small body whereby the open, high, low and close are roughly the same. There is a long lower wick beneath the body which should be more than twice the length of the candle body. The body may be bullish or bearish, however bullish is considered more favorable.

USO U S. Oil Fund LP Stock Price, Quotes and News

The United States Oil Fund® LP (USO) is an exchange-traded security whose shares may be purchased and sold on the NYSE Arca. Specifically, USO seeks for the average daily percentage change in USO’s net asset value, for any period of 30 successive valuation days, to be within plus/minus 10% of the average daily percentage change in the price of the Benchmark Oil Futures Contract over the same period. The United States Oil Fund was issued on April 10, 2006, by the United States Commodity Fund. The fund’s investment objective is to provide daily investment results corresponding to the daily percentage changes of the spot price of WTI crude oil to be delivered to Cushing, Oklahoma.

„(Meanwhile) the jump in crude oil prices following Saudi Arabia’s decision to extend its unilateral production cut until year end has probably helped prevent an even deeper setback for gold as it not only raises inflation but also growth concerns,“ Saxo Bank’s Ole Hansen said. Take a look at some ETFs that can benefit from the latest rally in oil prices due to a variety of factors including easing Omicron variant concerns. Investors seeking to tap the oil rally could bet on the ETFs that are directly linked to the futures contracts. Though the news of continuation of China’s zero-Covid policy cast a pall over oil prices on Monday, it is likely to be a short-term drag. As of June 2021, the price of oil has started to increase and is trading around $76 a barrel. This is after a steep decline amidst the global coronavirus epidemic, when the price was trading at around $19 a barrel in May 2020.

In late April, the price of USO dropped more than 30% to just above $2 per share and new trades were halted as the fund’s managers began making structural changes in efforts to avoid a complete collapse. USO management then announced a 1-8 reverse share split for USO to go into effect after the market close on April 28, 2020. A reverse split reduces the number of shares outstanding into fewer and proportionally higher-priced shares. Such action is often interpreted by analysts and investors that the stock, or exchange-traded product, is having trouble holding its perceived value.

In this piece, we will take a look at the ten worst performing commodity ETFs in 2023. If you want to find out what the fuss is all about in the commodities world, then check out 10 Worst Performing Commodity ETFs in 2023. Oil prices are soaring this year as global economies are recovering from the pandemic-led slump.

USO’s investment objective is for the daily changes, in percentage terms, of its shares’

NAV to reflect the daily changes, in percentage terms, of the spot price of light sweet

crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the

Benchmark Futures Contract. Specifically, USO seeks for the average daily percentage

change in USO’s net asset value, for any period of 30 successive valuation days, to be

within plus/minus 10% of the average daily percentage change in the price of the

Benchmark Oil Futures Contract over the same period. Although the fund invests its assets primarily in exchange-listed crude oil futures contracts and oil-related futures contracts, such as natural gas futures contracts, the fund may also invest in swap and forward contracts.

Exchange-traded funds that let investors bet on energy prices and stocks are among the most popular offerings judging by their considerable trading volume, but some of these funds have been slammed by the severe correction… The adjacent table gives investors an individual Realtime Rating for USO on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. The „A+ Metric Rated ETF“ field, available to ETF Database Pro members, shows the ETF in the Oil & Gas with the highest Metric Realtime Rating for each individual field.

Since all futures contracts have an expiration date, the United States Oil Fund must actively roll its front-month futures contract to the WTI crude oil futures contract expiring in the next month to avoid taking delivery of the commodity. The fund primarily holds front-month futures contracts on crude oil and has to roll over its futures contracts every month. For example, if it holds WTI crude oil futures contracts that expire in September 2020, it must roll over its contracts and purchase those that expire in October 2020. Crude oil and natural gas are among commodities that have historically experienced long periods of contango.

USO Price and Volume Charts

Oil prices have soared to their highest levels in many years due to geopolitical tensions in Europe and the Middle East. Greg Brown, fund analyst for Morningstar Inc., says that the new „managed payout funds“ offered by fund firms like Vanguard and Fidelity are an intriguing idea, but not yet proven sufficiently to be worth buying. Politics has become so interwoven with finance that you need a degree in politico-economics to get investing in this market right.

Investment in small companies generally experience greater price volatility. As an example, in April 21, 2020, the price per USO share sold in the secondary market was 36% higher than the end of day per share NAV of USO. This discrepancy was attributable to increased demand for USO shares due to market forces and USO’s having temporarily halted the sale of Creation Baskets. Contrary to contango, backwardation occurs when the price of a futures contract of an underlying asset is below its expected future spot price. Consequently, backwardation causes investors to profit when rolling expiring futures contracts to futures contracts expiring at a later month.

Government regulation and taxation Investments held in U.S. government securities and money market instruments can suffer losses. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. If Warren Buffett’s hedge fund didn’t generate any outperformance (i.e. secretly invested like a closet index fund), Warren Buffett would have pocketed a quarter of the 37.4% excess return. Daring to drink the water of the emerging markets funds could prove to be little more than a way to tap into Montezuma’s revenge. But history tells us that investors who discount the rewards are as prone to disappointment … ETF Trends and ETF Database , the preeminent digital platforms for ETF news, research, tools, video, webcasts, native content channels, and more.

- Therefore, the United States Oil Fund suffers from negative roll yields when purchasing further dated WTI futures contracts as the front-month futures contract expires.

- Back then they weren’t called hedge funds, they were called “partnerships”.

- These Funds, which are ETPs, are not mutual funds or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and are not subject to regulation thereunder.

- Prices also got a boost from a weaker dollar and strong loan data from top consumer China.

Between 1957 and 1966 Warren Buffett’s hedge fund returned 23.5% annually after deducting Warren Buffett’s 5.5 percentage point annual fees. S&P 500 Index generated an average annual compounded return of only 9.2% during the same 10-year period. An investor who invested $10,000 in Warren Buffett’s hedge fund at the beginning of 1957 saw his capital turn into $103,000 before fees and $64,100 after fees (this means Warren Buffett made more than $36,000 in fees from this investor). Major exchange-traded funds pegged to moves in crude oil are on track for their biggest weekly gain in more than a year, boosted as OPEC unexpectedly reached a deal to cut production – a move that could address the commodi…

Asian Markets Close Lower, European Markets Trade In Red While Commodities Gain – Global Markets Today While US Was Sleeping

ETF Database analysts have a combined 50 years in the ETF and Financial markets, covering every asset class and investment style. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. The August inflation numbers on Wednesday could determine the Fed’s near-term policy path, and signs of high price pressure could again fan fears of the Fed leaving interest rates higher for longer. Jerome Powell in his latest remarks have kept the door open for additional hikes, as other policymakers disagree on where rates could go from here.

USO tends to track the price of oil pretty well, and its performance over the trailing 1-, 5-, and 10-year periods is 20.34%, -12.18%, and -19.8%, respectively. GLDX, SDCI, UDI, UMI, USE, ZSB, and ZSC shares are not individually redeemable. Individual investors must buy and sell GLDX, SDCI, UDI, UMI, USE, ZSB and ZSC shares in the secondary market through their brokerage firm. In base metals, copper prices traded https://bigbostrade.com/ higher, as investors watched for U.S. inflation figures and China’s latest economic data, even as concerns remained over the beleaguered property sector. Prices also got a boost from a weaker dollar and strong loan data from top consumer China. Take a look at some ETFs that can benefit from the latest rally in oil prices due to growing fuel consumption and OPEC+’s decision to increase fuel production gradually.

This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply. USCI, USO, USL, BNO, UNG, UNL, UGA, and CPER are commodity pools regulated by the Commodity Futures Trading Commission. These Funds, which are ETPs, are not mutual funds or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and are not subject to regulation thereunder. Gold is seen as a hedge against inflation and economic uncertainty, although a higher rate environment dents its appeal. Get this delivered to your inbox, and more info about our products and services. As you can guess, Warren Buffett’s #1 wealth building strategy is to generate high returns in the 20% to 30% range.

Financial Advisor Report

The daily changes are measured by the daily percentage changes in the price of near-month WTI crude oil futures contracts traded on the NYMEX. If the front-month futures contract is approaching two weeks until its expiration date, the WTI crude oil futures contract expiring the following month is the fund’s benchmark. USO invests primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels.

USO invests primarily in listed crude oil futures contracts and other oil-related contracts, and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of 2 years or less. The Fund seeks to have the changes in percentage terms of the units’ net asset value reflect the changes in percentage terms of the price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the how to become a forex trader changes in the average of the prices of 12 Futures Contracts. Contango occurs when the price of a futures contract on an underlying asset is above its expected future spot price. Since the front-month futures contracts are cheaper than those expiring further out in time, the futures curve is said to be upward-sloping. This causes negative roll yields because investors will lose money when selling the futures contracts that are expiring and purchasing further dated contracts at a higher price.

The parameters for USO’s investment discretion are set forth and discussed in detail in USO’s prospectus. USO can change such parameters if regulatory requirements, market conditions, liquidity requirements or other factors make it necessary for USO to do so. USO’s portfolio holdings, as well as its investment intentions with respect to the type and percentage of investments in USO’s portfolio, are disclosed daily on the portfolio holdings page of the website.

NEW Sample Issue of Insider Monkey’s Monthly Newsletter and 1 Free Stock Pick

These events severely limited USO’s ability to have a substantial portion of its assets invested in the Benchmark Oil Futures Contract. Accordingly, on April 17, 2020, USO commenced investing in oil futures contracts other than the Benchmark Oil Futures Contract, consistent with its authority to do so pursuant to its prospectus. In April 2020, crude oil prices collapsed amid the COVID-19 pandemic to 20-year lows.

To view all of this data, sign up for a free 14-day trial for ETF Database Pro. To view information on how the ETF Database Realtime Ratings work, click here. Exchange-traded funds focused on oil and gas dropped Monday, as investors weighed as well as economic data prompting concerns that the Federal Reserve may need to keep up its aggressive monetary tightening for longer.

Oil ETFs to Ride the Crude Rally

Actually Warren Buffett failed to beat the S&P 500 Index in 1958, returned only 40.9% and pocketed 8.7 percentage of it as “fees”. His investors didn’t mind that he underperformed the market in 1958 because he beat the market by a large margin in 1957. That year Buffett’s hedge fund returned 10.4% and Buffett took only 1.1 percentage points of that as “fees”. S&P 500 Index lost 10.8% in 1957, so Buffett’s investors actually thrilled to beat the market by 20.1 percentage points in 1957. Warren Buffett never mentions this but he is one of the first hedge fund managers who unlocked the secrets of successful stock market investing. Back then they weren’t called hedge funds, they were called “partnerships”.

The Fund seeks to reflect the performance of the spot price of West Texas Intermediate light, sweet crude oil delivered to Cushing, Oklahoma by investing in a mix of Oil Futures Contracts and Other Oil Interests. The United States Oil Fund has underperformed the spot price of WTI crude oil and has not correctly measured its daily performance over the past five years. Consequently, investors who are bullish on oil over the long term may want to stay away from this fund due to its underperformance. Oil prices have been quite volatile over the past two decades, rising as high as over $140 and as low as $20. This chart shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark futures contract(s). The values indicate what $10,000 would have grown to over the time period indicated.

Take a look at some ETFs that can benefit from the latest rally in oil prices due to intensifying situations between Russia and Ukraine. Take a look at some ETFs that can benefit from the latest rally in oil prices following the EU’s agreement to ban 90% of Russian crude by 2022 end. Scott Burns, director of ETF research for Morningstar, says that the financial-services sector may have „a lot of value right now, but it’s also got a lot of risk and volatility,“ and he cautioned average investors to stay…

A long-running debate in asset allocation circles is how much of a portfolio an investor should… The following charts reflect the allocation of

USO’s

underlying holdings. The following charts reflect the geographic spread of

USO’s

underlying holdings. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time.

In constructing a frequency distribution, as the number of classes is decreased, the class width: a decreases b. remains unchanged c. increases d. can increase or decrease depending on the data values

A frequency distribution is a listing of frequencies of all categories of the observed values of a variable. When constructing a frequency distribution, as the number of classes is decreased, the class width increases. On counting all of the frequencies we obtain the desired class intervals and their frequencies. These methods are especially useful in event history analysis because patterns of variation over time and across cases are complex and are not easily captured by a single statistic. A consequence of the fact that the radon concentrations are approximately lognormally distributed is that the geometric mean of the radon concentrations is a more meaningful distribution summary than the arithmetic mean. For example, a single extra-large radon concentration found in one home may have a drastic effect on the arithmetic mean, but it will have little effect on the geometric mean.

- For larger samples, there is an approximation that is useful both in practice and in deriving methods of statistical inference.

- A consequence of the fact that the radon concentrations are approximately lognormally distributed is that the geometric mean of the radon concentrations is a more meaningful distribution summary than the arithmetic mean.

- For example, it is often found that, while the concentrations of an air or water pollutant (such as sulfur dioxide in the air or phenol in river water samples) are not nomially distributed, their logarithms are.

- Therefore, it is customary to define categories as intervals of values, which are called class intervals.

Then the probability of y successes and (n−y) failures is py(1−p)n−y. A pointwise confidence interval is the confidence interval at a single time t. Usually a simultaneous confidence band around S(t) in constructing a frequency distribution as the number of classes are decreased the class width for a time interval is preferable. The pointwise confidence intervals of ŜKM(t) and ŜKM(u) at times t and u, respectively, are not statistically independent when estimated from the same data.

SUMMARY OF DISTRIBUTION CONCEPTS FROM CHAPTER 2

The life-table estimator smooths by computing the hazard rate for a time interval rather than at a time point. Alternatively, smoothing algorithms may be applied to estimates of the hazard rate at a set of adjacent time points in a manner analogous to computing a running mean. The normal distribution is very commonly encountered in science. It is obvious that if a random variable X is normally distributed, functions of that random variable (such as X2,X3,logX, and 1-X) will usually not be normally distributed.

Therefore, the class width is indeed the same as the class size. The probability of y successes, then, is obtained by repeated application of the addition rule. That is, the probability of y successes is obtained by multiplying the probability of a sequence by the number of possible sequences, resulting in the above formula.

4 Distributions

A frequency distribution of the variable price is shown in Table 1.6. Clearly the preponderance of homes is in the 50- to 150-thousand-dollar range. To provide more information, we will construct frequency distributions by grouping the data into categories and counting the number of observations that fall into each one. Because we want to count each house only once, these categories (called classes) are constructed so they don’t overlap. Because we count each observation only once, if we add up the number (called the frequency) of houses in all the classes, we get the total number of houses in the data set. Nominally scaled variables naturally have these classes or categories.

Impaired OTUD7A-dependent Ankyrin regulation mediates neuronal … – Nature.com

Impaired OTUD7A-dependent Ankyrin regulation mediates neuronal ….

Posted: Fri, 06 Jan 2023 08:00:00 GMT [source]

In the case of radioactive decay, the memoryless property corresponds to the fact that the decay rate (the probability of decay per unit time interval) is independent of the age of the nuclei. If the failure rate of a component is modeled by an exponential distribution, the memoryless property corresponds to the failure being independent of age, i.e., the component shows no wear and tear due to its age. Failure rates that do not have the memoryless property are discussed in the section on the Weibull distribution. Table II shows some important special cases of this cumulative distribution function. Approximately 68% of the values in any normal population lie within one standard deviation (σ) of the mean µ, approximately 95% lie with two standard deviations of µ, and approximately 99.7% lie within three standard deviations of µ. Another presentation of a distribution is provided by a pie chart, which is simply a circle (pie) divided into a number of slices whose sizes correspond to the frequency or relative frequency of each class.

The total number of data items with a value less than or equal to the upper limit for the class i

The parameter β is a shape parameter affecting the shape of the distribution, while α is a scaling parameter affecting the scale. It is also possible to change the location of the Weibull distribution by replacing the variable x by x-x0. Repeated physical measurements, such as measurements of the length of an object, are usually normally distributed. Data from any distribution (whatever its form) have a mean whose distribution is approximately normal.

Enzyme adaptation to habitat thermal legacy shapes the thermal … – Nature.com

Enzyme adaptation to habitat thermal legacy shapes the thermal ….

Posted: Fri, 24 Feb 2023 08:00:00 GMT [source]

The mean of a probability distribution is often called the expected value of the random variable. For example, the expected number of individuals in a couple who have had measles is 0.4. This is a “long-range expectation” in the sense that if we sampled a large number of couples, the expected (average) number of individuals who have had measles would be 0.4. Note that the expected value can be (and often is) a value that the random variable may never attain.

constructing frequency distribution;, a5 the number of classes is decreased, the class width

An integer related to sample size that determines which member of a family of probability distributions is appropriate in a particular case. The standard normal has only one member and does not use df, but the t has many members and does use df. A relative frequency distribution consists of the relative frequencies, or proportions (percentages), of observations belonging to each category.

Is it important to keep the width of each class in a frequency distribution?

It is advisable to have equal class widths. Unequal class widths should be used only when large gaps exist in data. The class intervals should be mutually exclusive and nonoverlapping.

How do you construct a frequency distribution?

- Step 1: Sort the data in ascending order.

- Step 2: Calculate the range of data.

- Step 3: Decide on the number of intervals in the frequency distribution.

- Step 4: Determine the intervals.

- Step 5: Tally and count the observations under each interval.

Best Stock-Picking Advice for New Investors

Contents:

Investors on the brink of retirement will most likely need to tap into their portfolio sooner rather than later and want to switch to an investment strategy that reduces their risk exposure. REIT investing for income or bonds are a great example of what older investors may look to prioritize. If you’re a beginner in the world of stock trading, we recommend reading our article “Investing in stocks – what is stock trading? ” where we explain some of the more basic terms, including stocks, stock market, fundamental vs technical analysis, trading vs investing. Microcap securities, sometimes referred to as penny stocks, include low-priced securities issued by small companies with low market capitalization.

The GAAP net income came to $180 million, or 55 cents per share, up 36% y/y, and by non-GAAP measures, the income of $213 million was up 16% y/y. The company has deep pockets, although cash reserves are down from 2021; Juniper finished 2022 with $1.23 billion in cash and liquid assets, compared to $1.69 billion at the end of 2021. Looking ahead, Juniper guided toward a 15% y/y revenue gain for 1Q23, to approximately $1.34 billion. TD Ameritrade does not charge platform, maintenance, or inactivity fees. Please review our commission scheduleand rates and fees schedulefor details.

The easiest and most practical way to buy stock is to open an account with an online broker or investment platform. All investing is subject to risk, including the possible loss of the money you invest. Diversification does not ensure a profit or protect against a loss. There are 4 ways you can place orders on most stocks and ETFs, depending on how much market risk you’re willing to take. BENZINGA receives excellent reviews across a wide swath of investors who use its services.

Dividends

Definitive goals may simultaneously give investors direction and set the bar for what they deem to be a success. Without a goal in place, investors will have nothing to compare their progress to, making improving all the more difficult. Additionally, specific goals will help investors determine their own investing approach, of which there are many. If the share prices of stocks you’re interested in are financially out of reach, you can also explore fractional shares. Fractional shares allow you to buy fractions, or parts of a stock. If, for example, a single share is $500, you can buy $50 worth of the stock, giving you a fraction worth 10% of a share.

They are willing to take a higher degree of risk for the chance of big gains. That pretty much covers the basics, whether or not you’ve waded through the more complicated concepts of technical analysis. These value-focused mutual funds and ETFs all earn Morningstar Analyst Ratings of Silver or better. The fixed-income-focused exchange-traded funds on this list all earn Morningstar’s top rating. These cheap high-quality stocks from the Morningstar Wide Moat Focus Index are attractive for long-term investors. Here are Morningstar’s best international-stock and ETF picks today.

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our AI-powered stock analytics platform will help you pick the best stocks and optimize your portfolios’ performance. +600 technical, 150 fundamental, and https://day-trading.info/ 150 sentiment daily indicators per stock, processed into more than +10,000 daily features by our Artificial Intelligence. Danelfin’s AI does the hard work, analyzing +10,000 features per day per stock and rating stocks probability of beating the market with the AI Score.

These securities are primarily traded on the over-the-counter market. While microcap companies can be real businesses developing or offering products or services, the microcap sector has a long history of bad actors engaging in price manipulation and other fraud. However, even in the absence of fraud, microcap stocks can present higher risks than the stock of larger companies. This is largely because relatively little information is available about microcap companies compared with larger companies that list their securities on national exchanges.

Motley Fool Rule Breakers Review: Is It Better vs Stock Advisor?

First, figure out how hands-on you want to be, open an account, choose between stocks and funds, set a budget, focus on the long-term, and finally, manage your portfolio. Learn how to invest in stocks, including how to select a brokerage account and research investments. Stocks that pay dividends offer you an additional payout on top of the potential price appreciation. A high dividend yield means you could potentially see solid income from a stock. Stocks are listed on a stock exchange, which facilitates the buying and selling of shares between parties.

How should a beginner invest in stocks?

One of the easiest ways is to open an online brokerage account and buy stocks or stock funds. If you're not comfortable with that, you can work with a professional to manage your portfolio, often for a reasonable fee. Either way, you can invest in stocks online and begin with little money.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. To illustrate this process, let’s assume you’re the kind of trader who holds a stock anywhere from a few days to a few weeks. Once you’ve got a more manageable list of five or six, it’s time to apply some technical screens.

The bottom line on investing in stocks

Because of this, the Rule Breakers’s portfolio can experience dramatic price swings. The companies it invests in are some of the most volatile on the stock market – high-flying tech companies with rapidly increasing revenues and the potential to disrupt entire industries overnight. Big Money certainly seems to be impressed with the company’s prospects.

Discount brokerage firms offer fewer services but, as their name implies, generally charge less to execute the orders you place. A sector is a large section of the economy, such as industrial companies, utility companies or financial companies. Industries, which are more numerous, are part of a specific sector. For example, banks are an industry within the financial sector. An important additional difference between common stock and preferred stock has to do with what happens if the company fails.

- The stocks that typically move last in a sector are those that are less important in overall weightings, such as Advanced Micro Devices or LSI Logic , which have a combined weighting of just 4.72%.

- But you want to find the very best stocks right now to generate massive gains.

- You might also explore how much you need to save for retirement based on your age.

- Therefore, when the Wall Street pros consider a name to be a “Top Pick,” investors should take note.

- While stocks are great for many beginner investors, the „trading“ part of this proposition is probably not.

Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Members should be aware that investment markets have inherent risks, and past performance does not assure future results. Investor Junkie has advertising relationships with some of the offers listed on this website. Investor Junkie does attempt to take a reasonable and good faith approach to maintaining objectivity towards providing referrals that are in the best interest of readers. Investor Junkie strives to keep its information accurate and up to date.

Understand the market

It also offers an Admiral Shares short-term bond mutual fund under the ticker symbol VSBSX, which also has a $3,000 minimum investment requirement. Stock investing is filled with intricate strategies and approaches, yet some of the most treasury reporting rates of exchange successful investors have done little more than stick with stock market basics. Once you have a preference in mind, you’re ready to shop for an investment account. For the hands-on types, this usually means a brokerage account.

Day trading, it’s good to avoid the habit of compulsively checking how your stocks are doing several times a day, every day. Some providers require a certain percentage of an account to be held in cash. The providers generally pay very low interest on the cash position, which can be a major drag on performance and may create an allocation that is not ideal for the investor. These required cash allocation positions are sometimes more than 10%.

Remember, nobody starts investing in the stock market as a veteran. Developing the slightest working knowledge of how stocks are traded requires time and effort, but it’s never too late to get started. Here’s an introduction to investing in stocks for beginners, and hopefully, the catalyst many people have been waiting for to start investing themselves. Keep up with the progress of your investments, but don’t place too much weight on daily fluctuations because, as previously mentioned, it’s best to think long-term when buying stocks.

This continued outperformance could build substantial wealth by following the service’s “Very Bullish” Top Quant Ratings recommendations. Barron’s case for or against a specific stock over the course of the next year. Stocks in public companies are registered with the SEC and in most cases, public companies are required to file reports to the SEC quarterly and annually. Annual reports include financial statements that have been audited by an independent audit firm. Information on public companies can be found on the SEC’s EDGAR system.

Simplify your stock selection

In that event, there is a priority list for a company’s financial obligations and obligations to preferred stockholders must be met before those to common stockholders. On the other hand, preferred stockholders are lower on the list than bondholders. While these indicators can be time-consuming to find on your own, some investors are turning toartificial intelligence for speedy access to the most up-to-date information. If a company goes bankrupt and its assets are liquidated, common stockholders are the last in line to share in the proceeds. The company’s bondholders will be paid first, then holders of preferred stock.

What are the 10 best stocks to buy right now?

- Comcast CMCSA.

- Taiwan Semiconductor Manufacturing TSM.

- Roche Holding RHHBY.

- Walt Disney DIS.

- Equifax EFX.

- TransUnion TRU.

- International Flavors & Fragrances IFF.

- Anheuser-Busch InBev BUD.

Other times that same industry could be stagnant and have little investor appeal. Like the stock market as a whole, sectors, industries and individual companies tend to go through cycles, providing strong performance in some periods and disappointing performance in others. You can place buy and sell orders for stocks online, through a mobile app, or by speaking with your registered investment professional in-person or over the phone. If you do trade online or through an app, it’s important to be wary of trading too much, simply because it’s so easy to place the trade.

Some companies allow you to buy or sell their stock directly through them without using a broker. This saves on commissions, but you may have to pay other fees to the plan, including if you transfer shares to a broker to sell them. Some companies limit direct stock plans to employees of the company or existing shareholders.

Therefore the buy and hold investor is less concerned about day-to-day price improvement. Growth companies in particular often receive intense media and investor attention, and their stock prices may be higher than their current profits seem to warrant. That’s because investors are buying the stock based on potential for future earnings, not on a history of past results. If the stock fulfills expectations, even investors who pay high prices might realize a profit.

How many stocks should a beginner buy?

Most experts tell beginners that if you're going to invest in individual stocks, you should ultimately try to have at least 10 to 15 different stocks in your portfolio to properly diversify your holdings.

JustForex forex broker: JustMarkets review: Is it a legit or scam forex broker?

Contents:

While some traders may prefer to have access to even more trading platforms, considering the capabilities of MetaQuotes’ creation, however, that is well enough. Now they are giving options which we do not use in Kenya and Neteller is another company difficult to open and account with which is one of the options which JUSTMARKETS is giving! DO NOT USE this company as your broker think before opening…. JustForex offers floating spreads with the ECN accounts, having tighter spreads than the standard account types. The MT4 offered by JustForex is fully customized to meet the needs of traders according to the account they are trading in. With JustForex, demo traders can access most of the features to ensure that they are fully prepared to handle live accounts.

From our viewpoint, this broker does not provide enough materials for trader education. They also do not participate in activities that challenge traders to keep learning or offer regular webinars. JustForex is available in over 12 languages to include English, French, Portuguese, Russian, Spanish, Indonesian, Chinese, Vietnamese, Thai, Korean, Arabic and Malay.

Analyze quotes, draw forecast lines and figures, use indicators and create new orders directly from your phone. According to the JustForex website, the maximum processing time for withdrawals is within one banking day. Yes, JustForex caters to both beginners and experienced traders. Yes, JustForex charges commissions on the Raw Spread Account of 3 units of the base account currency per side/per lot. The purpose of an Islamic Account is that it caters specifically to Muslim traders who follow Sharia law.

They will answer and provide support for any questions quickly. I do not hesitate to recommend you to do so.Thanks JUSTFOREX. Search by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers. I have been using justforex for quite some time now. I totally recommend this broker to all traders out there.

Broker Types

Deep Liquidity , And International Security Standards Are A Part Of Justforex’s Efforts To Guard Its Shoppers. Negative Balance Protection Exists, However Deposit Insurance Is Absent. The Company Was Established In 2012 And limefx Relies On St. Vincent And Therefore The Grenadines. JF Global Restricted Is That The Company Owner Of The Whole And Offers Over One Hundred Seventy Trading Instruments Across Four Account Sorts That Suit All Monger Levels.

Experienced traders know that St Vincent and the Grenadines is not exactly a regulatory jurisdiction that lends financial operators any kind of weight compliance-wise. For a while, the broker also listed Belize and its IFSC as a regulator, though other than the listing itself, there was no proof made available in this regard. However, in 2019 the company moved this licence to St. Vincent as a reaction to Belize’s unstable banking sector. The move was reportedly done in order to safeguard customer funds.

Can I Leave Orders Open over Weekends? – Action Forex

Can I Leave Orders Open over Weekends?.

Posted: Fri, 03 May 2019 07:00:00 GMT [source]

We keep on reminding traders to be wary of offshore brokers as they don’t provide any funds protection as well as withdrawals guarantee. If you are looking for brokers to deal with, we would recommend brokers regulated by top-tier regulators like FCA, CySEC, ASIC, etc. Servicing more than 3.5 Mill clients from more than 190 countries in more https://limefx.vip/ than 30 languages. Over 2.5 Billion trades executed with no requotes or rejections. Access to 1000+ instruments from 6 asset classes, 16 full feature trading platforms, 4 trading account types, 25+ secure payment methods and 24/5 personal customer service. The broker offers some 3 account types which do not require a minimum deposit at all.

How to open a Forex trading account with JustForex?

Launched in 2012, JustForex has slowly grown into an online Forex industry veteran. Unfortunately, its reputation does not seem to match its experience. All your withdrawals were successfully completed. Sorry for the delay and for any inconvenience caused to you. All the necessary measures were taken in order to prevent such situations in the future. Your response via email will be much appreciated.

LimeFx continues to grow from strength to strength by offering traders just what they need to be successful in the markets. The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices.

- The bonuses and promotions run by the broker have often been described as deceitful as well.

- For that kind of money, traders get to trade for more or less meaningful amounts.

- Yes, JustForex is a legit Forex Broker and Trade Platform.

- Negative Balance Protection Exists, However Deposit Insurance Is Absent.

Expert Advisors are designed to handle automated trading. Custom scripts can also be tossed into the mix to optimize results. We use dedicated people and clever technology to safeguard our platform. Companies can ask for reviews via automatic invitations.

JustForex AT A GLANCE

How to get HYCM’s Welcome Bonus and Cashback on Cryptocurrency Deposit HYCM offers a 10% welcome bonus and 2.5% cashback when depositing in cryptocurrencies. How to start using Aximtrade’s Infinite Leverage account? How to open Aximtrade’s Infinite Leverage account? See the conditions and more about leveraged Forex trading here. MAM Accounts receive the same superior low latency execution as standard accounts.

7 Best Forex Brokers in South Africa – Letaba Herald

7 Best Forex Brokers in South Africa.

Posted: Tue, 09 Feb 2021 08:00:00 GMT [source]

First they emailed me that my trading strategy is risky so they are protecting my funds by lowering leverage ration and they refused to set it back. JustMarkets is a Seychelles forex broker established in 2012 and regulated by the FSA-S. Alongside a massive selection of FX pairs, the broker offers an astonishing range of crypto/crypto and crypto/fiat pairings. This selection covers BTC, XRP, ETH, ETC, NEO, LTC and DSH among others. Last but not least, we have the dedicated Crypto Account, which does not come with a minimum deposit requirement either. Raising the stakes one step further is the ECN Zero Account.

Unique Features

This broker also regularly offers bonuses and promotions to encourage account opening. This account offers traders the best possible spreads, especially to those who use day trading or intraday trading strategies, frequent inputs, outputs, and short timeframes. This account is dedicated to scalpers, and it features the following.

While these trading instruments are hardly regulated in any way, they do offer traders exposure to some of the most dynamic and interesting tradable assets. JustMarkets is the new brand of the trusted Justforex broker that continues to provide top-notch LimeFx and financial services worldwide. No, you cannot start trading with no money at JustForex. This is because JustForex does not offer any deposit bonus, therefore traders will need to deposit their funds when opening a Trader Account. The Standard account from JustForex is the most popular one. It includes the basic set of necessary options, really tight spreads starting with 0.3 pips, and no commissions.

LimeFx Forex Trade Platform and Broker Review

The Raw Spread Account is the ideal option for scalpers and traders who work on short time frames and accuracy. The Standard Account is the most popular option that caters to the trading needs and objectives of most traders. JustForex offers social trading opportunities, the use of MetaTrader 4 and MetaTrader 5, and a range of tradable financial instruments. JM’s edge is really just their high leverage if you know how to make good use of it.