Contents:

Should a forex trading robot not be able to handle a variety of order sizes, it will not make it to our recommendation list. There is a huge amount of different trading styles and strategies that you may use trading Forex. So, let’s look closely to identify those groups and their differences. Sometimes the represented trading results of the Forex robot are possible only on a demo account or if manipulating the results. It could not be clearly seen but any professional trader can see it analyzing trading charts.

9 „Best“ AI Stock Trading Bots (February 2023) – Unite.AI

9 „Best“ AI Stock Trading Bots (February .

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

Perhaps a more reliable way of automating your day trading endeavours is to the eToro Copy Trading too. This allows you to copy a skilled day trader like-for-like in a fully regulated environment. Similarly, even those that know how to invest well will often opt for an automated copy trading platform – as they simply don’t have the time to actively invest. The most challenging part of the process is finding a suitable automated trading platform for you and your financial goals.

The 5%ers Funding Forex Traders & Growth Program – Copyright © 2022

So, let’s see what the exact parameters and fhttps://trading-market.org/tures our automated rating system takes into account to reveal the best Forex expert advisors. As per the above, once you receive the signal in real-time via Telegram, it’s then simply a case of heading over to your chosen broker and placing the suggested orders. Users can, of course, decide to perform some independent market data research of their own before acting or ignore the signal altogether.

Because trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets. Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit from a trade. Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. For instance, if an order to buy 100 shares will not be incorrectly entered as an order to sell 1,000 shares. Besides developing their automated Forex trading solution, the best compromise remains social trading and creating a well-diversified trading strategy across ideas and sectors.

The Best Broker for Capitalise.ai

Similar to MetaTrader’s Expert Advisors , cBots are the platform’s trading robots that allow for full automation. In addition to a forward-looking live simulator, Capitalise.ai allows traders to assess the success of their automations based on past market conditions. Note, however, that the data provided may be more limited than other trading tools – months, rather than years.

In the MetaTrader community, trading robots are referred to as Expert Advisors , while on cTrader they are cBots. Designed to allow traders to develop complex trading systems and automations with no knowledge of coding, ProRealTime’s automatic trading tool ProOrder brings accessibility to technical trading. Use the inbuilt wizard to define stops, objectives and conditions, then let the code generator do the rest. The Standard account, which operates on a dealing-desk model, nevertheless offers similarly attractive spreads starting at 1.0 pips. If the robots have been properly programmed and tested to ensure proper performance they can be profitable. Naturally, there are downsides to using an automated forex trading robot.

Algo Signals is a Forex robot provider that presents traders with opportunities for both automated and semi-automated trading facilities. Even though backtesting is a great tool to determine the efficiencyof your automated forex trading system, you should keep in mind that it has a shortcoming. The results of static data cannot always represent what will happen in a live market situation.

Merrill Edge review

Technology failures can happen, and as such, these systems do require monitoring. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. Remember, you should have some trading experience and knowledge before you decide to use automated trading systems.

For those new to technical trading, Capitalise.ai offers an extensive library of trading strategies with which to experiment. Similar to its predecessor, MT5 offers full automation capabilities in the form of Expert Advisors , but with some significant improvements. EAs developed for MT5 are written in the MQL5 programming language. Based on C++ and object-oriented, MQL5 offers greater flexibility and enhanced execution speed, as well as a larger selection of indicators.

Best Automated Forex Trading Software & Apps

In other words, with trading automation all or some of the trading tasks are performed for you by software running on a computer system. Take advantage of one-on-one guidance from our market strategists to develop and maintain a strong trading strategy. For traders who are seeking ultra-tight spreads with fixed commissions. You know the strongest sides of a robot you chose, so you can easily improve your own strategy. The date of launching lets you know how long it has been working. If the robot works for a long time it decreases chances that it’ll become a scam.

For example, some robots may go for higher risk strategies, whilst others are more risk-averse. Double-check which rules your robot abides by and ensure they tally with your investment goals. Top-notch robots use market data analysis along with market risk forecasts to make the best trading decisions going forward.

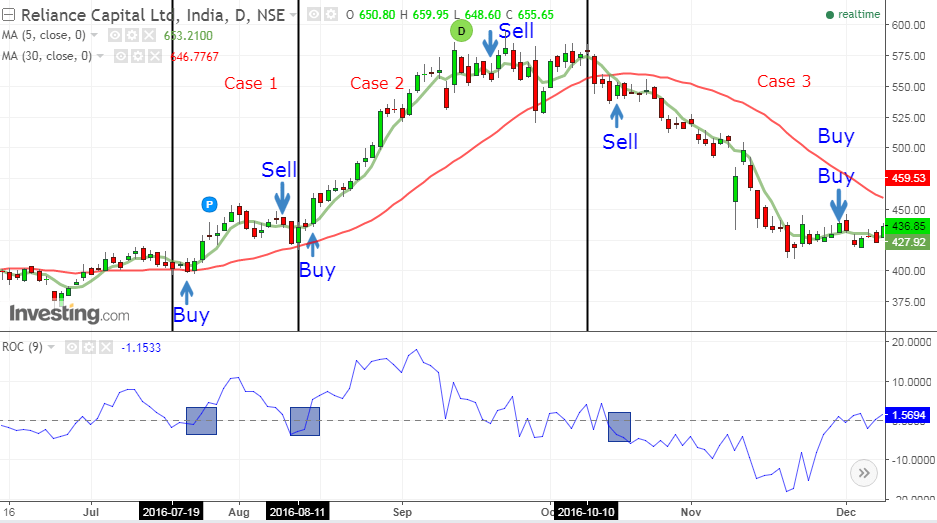

The analytical tools are not random; they must be clearly defined. For instance, a forex robot can be programmed to spot divergences between price and an oscillator such as the RSI. Robots can also be given the ability to use a candlestick pattern to define the precise entry price and use the recent highs and lows to set a stop loss or a take profit parameter.

What are the Risks Associated with Forex Trading Bot

All markets are suitable for automated trading software, but each requires a different solution. The three most popular trade markets remain Forex, index CFDs, and cryptocurrencies. Traders must use the appropriate automated trading software with the intended market sector to achieve the best trading results. To fully automate your forex and CFD trading, you’ll need to develop trading robots to run on a trading platform like MetaTrader 4, MetaTrader 5 or cTrader.

Even though https://forexaggregator.com/ authorities monitor unethical behavior, Forex is a somewhat gray market at the moment, and newbies fall into traps frequently. Some platforms provide trading signals in special Telegram/Discord groups, but most just suck money out of trustful pockets. These are called signal seller scams initiated mainly by investment account companies, pooled asset managers, and retail traders. Such groups or individuals with attractive portfolios charge newbies to share financial advice.

- This means that the trader will collect a percentage of all profits that it makes for you.

- Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas.

- Discover the latest trading trends, get actionable strategies and enjoy complimentary tools.

- When you set your parameters accurately, a trading bot can automatically trade for you.

For a long period, we professionally reshttps://forexarena.net/rch the Forex automated trading market. Over the years, we have gained experience that we systematically share with you in our reviews. Choosing an EA is a very important procedure, as it involves using it on a real account in order to make money. In the table, we have put together the ratings and results of the best trading robots performing. Using an automated forex robot without proper back-testing and research is risky.